Goldman Sachs Says the S&P 500 Will Rise 14% in 2021

This article was originally published on this site

With global markets rallying on the hopes that massive economic stimulus will accompany President-elect Joe Biden’s new administration, Goldman Sachs’ projection that the S&P 500 will end 2021 at 4,300 points seems even more realistic.

In our call of the day, the investment bank’s chief U.S. equity strategist David J. Kostin has mapped out the road to 4,300.

Goldman sees the S&P 500 SPX, -0.38% rising 14% through the year, after one of the world’s most closely watched indexes closed at 3,756 to finish 2020. A further 7% growth in the index is projected for 2022 — reaching 4,600.

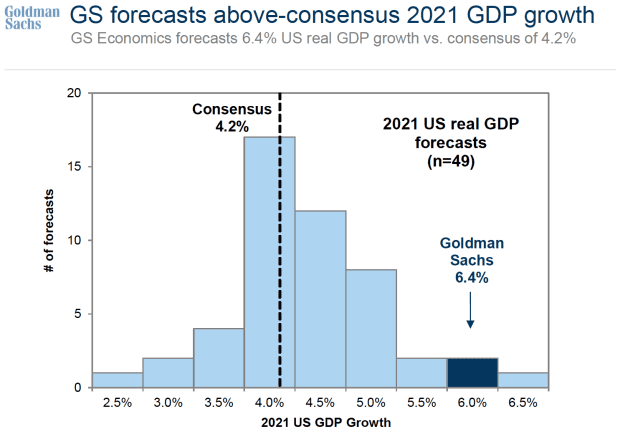

Underlying a double-digit forecast for returns in 2021 is the investment bank’s bullish projection on the U.S. economy — 6.4% real gross domestic product growth compared with the consensus of 4.2%.

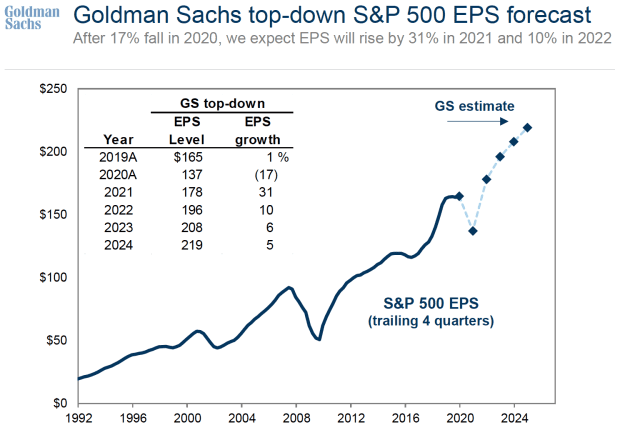

Adding to the economic boost for equities is a massive increase in earnings per share (EPS), a rebound from the dire impact the COVID-19 pandemic has had on corporate bottom lines. Goldman expects EPS to shoot up 31% in 2021 after falling 17% in 2020.

In tandem with EPS are projections of a strong rebound in margins, which Goldman expects to be higher than the bottom-up consensus forecast. An increase in margins is largely driven by operating leverage, as well as moderating costs like labor.

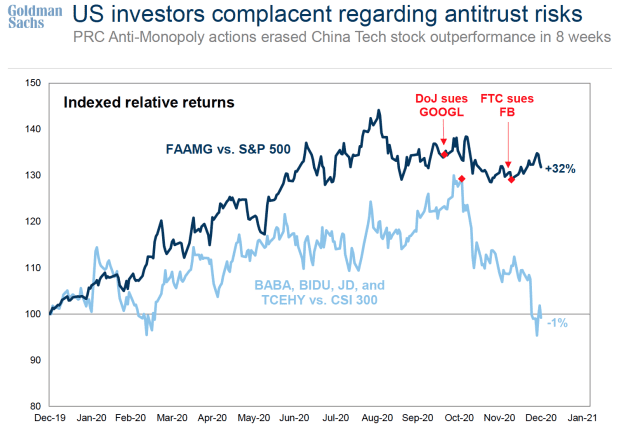

In many ways, the 18% rally on the S&P 500 in 2020 was helped by its five largest stocks: the technology giants Facebook FB, -2.38%, Amazon AMZN, -1.21%, Apple AAPL, -1.51%, Microsoft MSFT, -1.53%, and Alphabet GOOGL, -0.93%. These stocks returned 56% compared with 11% growth from the remaining 495 companies.

However, Goldman warns that investors are complacent about antitrust risks.

Whereas China’s antimonopoly actions wiped out the performance of Chinese tech stocks in just eight weeks, the market largely hasn’t reacted to the Justice Department’s lawsuit against Google and the Federal Trade Commission’s suit against Facebook.

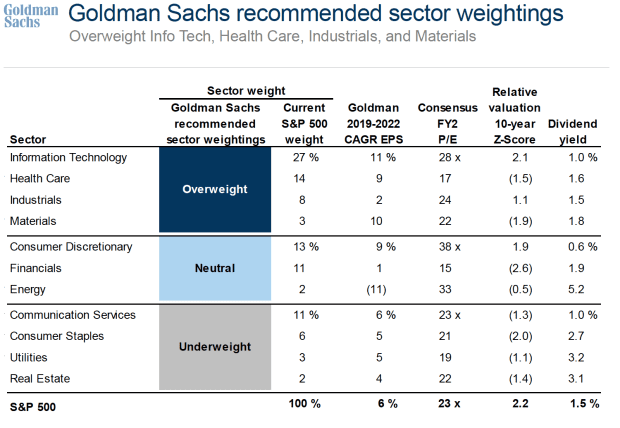

Closing out the road map to 4,300 is Goldman Sachs’ recommended sector weightings. The investment bank has information technology, health care, industrials, and materials classified as overweight, while communication services, consumer staples, utilities, and real estate are underweight.