3 Reasons Why this Biotech Rally is the Real Deal

This article was originally published on this site

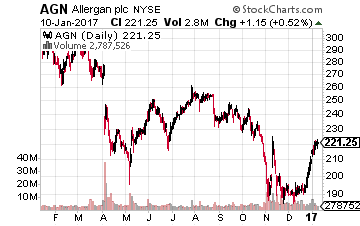

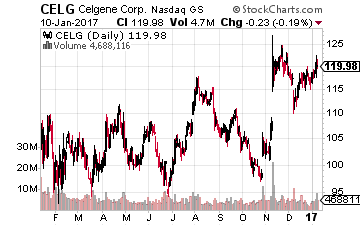

The biotech sector was one of the poorest performers in the market in 2016, dropping some 20%, but the sector has been greeted in the New Year with a breath of fresh air. The sector rallied over five percent in the first five trading sessions of 2017, and it feels like sentiment has gotten much more positive on this beaten down sector of the market. Let’s take a look at some of the reasons for the rally so far this year.

Valuations:

Thanks to a year and a half of substantially underperforming the market, valuations for the large cap behemoths of the industry dropped to the lowest collective levels since 2011. At some point, the “weak hands” get all washed out and sentiment has nowhere to go but up.

Investors saw something similar happen in the energy sector around the same time last year after that area of the market’s 18-month turn in investment “purgatory”. Energy turned out to be one the best-performing sectors in the market for 2016. In addition, lots of tax loss selling in the last quarter of 2016 probably resulted in biotech being oversold to start 2017.

A More Benign Regulatory Environment:

The President-Elect may issue an occasional tweet that might cause investors to temporarily have some concerns, however, given the congressional leadership’s priorities, new legislation on the industry is a non-starter. In addition, Mr. Trump has offered up several very pro-market nominees to head the major government health agencies.

The JP Morgan HealthCare Conference:

Every year, JP Morgan hosts one of the largest healthcare conferences of the year in San Francisco during January, and it is well-attended by analysts and fund managers. It is a place where companies come to tell their stories around pipeline development and how their businesses are doing.

M&A Is Picking Up:

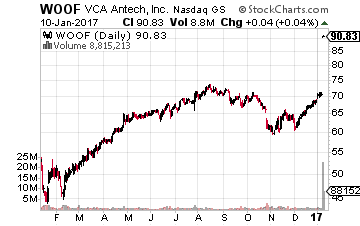

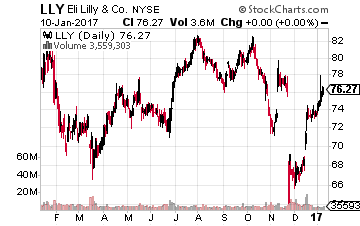

Most importantly, M&A activity is starting to noticeably pick up. This often happens around the time of this healthcare conference and boosts the “animal spirits” in the small and mid-cap parts of the sector. On Monday, Takeda bought mid-cap, ARIAD Pharmaceuticals (NASDAQ: ARIA), for over $5 billion with a 75% premium. Mars also announced it

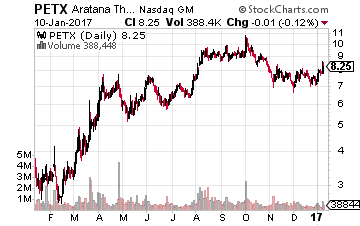

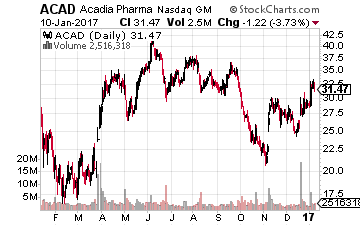

Acadia is one of the few plays between $5 billion and $15 billion in market capitalization left in the sector now that ARIAD has been purchased. Its primary drug is Nuplazid, which is approved for the psychosis found in 40% of Parkinson’s patients. Eventually, this will be is a $1 billion a year product.

The drug is in late-stage trials for the same symptoms commonly found in Alzheimers and Schizophrenia populations. I am also hearing reports the drug is already seeing some “off label” use outside its approved indication despite only being on the market since May. 20% of the float is owned by the Baker Bros. which has flipped numerous biotech plays over the years. Rumored interested parties include Pfizer among others.

All in all, it is shaping up to be a much more positive year for biotech than 2016, so if you’ve been sitting on the sidelines waiting for the right time to jump back in, I can’t see why you would wait any longer.