3 Stocks That Can Beat Buffett In The Long-term

This article was originally published on this site

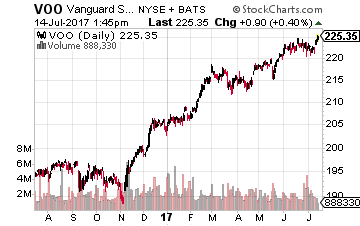

Warren Buffett’s best investment advice is to simply buy low-cost index funds.

Buffett says, “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors.”

The problem with this strategy, however, is that it inherently sets investors up for a large drawdown if, and when, the market corrects.

Nearly 15% of the Vanguard 500 ETF is invested in FAAMG stocks — all of which are tech names that will likely see a hard and fast correction once the market ‘resets.’ And being in the eighth year of a bull market, that could happen sooner rather than later.

Then why not just own Buffett’s own conglomerate — Berkshire Hathaway (NYSE: BRK-B) — which has beaten the market for decades.

There’s no doubt that Buffett is a great investor, but he owns a lot of ‘old economy’ companies. For starters, this month, Berkshire is making an even bigger bet on energy, trying to buy up Oncor Electric for $9 billion. Berkshire already gets nearly a quarter of its earnings from energy and railroad businesses.

As well, Buffett is getting close to handing over the reins at Berkshire. Greg Abel, who is the Berkshire Hathaway Energy CEO, is in the top spot for taking over for Buffett. With Abel at the helm, Berkshire will become even more reliant on utilities — and old world growth.

After ruling out the S&P 500 and Buffett’s Berkshire, investors might be better suited simply picking businesses that will continue to perform in this bull market, but that also offer some downside protection for when we see a correction.

Here are the top three stocks you should buy instead of taking Buffett’s advice:

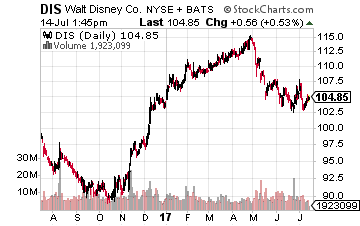

Disney has one of the best portfolios of assets for either a bustling economy or a struggling one. Shares of Disney have taken a recent tumble, down 15% from hitting all-time highs in 2015. The stock trades at just 15 times next year’s earnings estimates.

Its media networks, notably ESPN, are struggling, but that has created the buying opportunity. Rather, there could be an opportunity with spinning off ESPN, ABC and Disney Channel.

Disney would still have its network of theme parks, movie production business and consumer products. It has a list of prized assets and brands, including Star Wars and Marvel. It’s still creating big hit movies and finding ways to bring ‘classic’ characters back to life in the 21st century. The global rise in the middle class and disposable incomes should mean Disney continues to perform well over the next decade. As well it offers a modest, and sometimes overlooked 1.5% dividend yield.

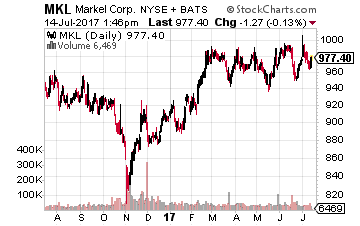

Markel has been called the mini-Berkshire. Both Berkshire and Markel trade near all-time highs, but Markel isn’t taking such an old world approach. Markel trades with a $14 billion market cap, compared to Berkshire’s $425 billion.

But instead of buying up old economy-style companies, Markel has a strong insurance and investment portfolio that supports its ability to invest in other growth areas of the market. Markel Ventures is one area where the company is seeing impressive growth, buying up companies like CapTech — an IT consulting firm — last year. Markel also invests in high-quality stocks, a strategy that Berkshire uses but has transitioned away from of late. Markel runs its company much like Berkshire, but it has a lot more runway for growth and constraints given its much smaller size.

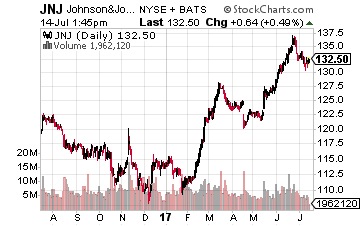

This behemoth consumer staples company is the perfect name if you’re worried about a market correction or a few years of underperformance. The S&P 500 trades at 26 times earnings and pays a 2% dividend yield. Johnson & Johnson trades at just 17 times next year’s earnings and has a 2.6% dividend yield — a dividend that it has increased every year for 54 consecutive years.

With consumer stable brands (i.e. Band-Aids, Neutrogena, Tylenol), medical devices and pharmaceuticals, Johnson & Johnson has a solid mix of products that sell regardless of the economy. Everyone needs toothpaste and soap during a recession.

Its products are consumed and disposed of, leading to repeat customers and keeping them coming back for more. This has helped Johnson & Johnson grow earnings for over 30 straight years.

In the end, for investors that want to be lazy, the three stocks above are great opportunities. These companies, and companies like them, appear to be much more efficient than owning an index of potentially overvalued companies or those that lack major growth opportunities.

Turning your retirement savings into a consistent stream of income is no easy task. You might spend hours researching what stocks to buy, only to end up with three seemingly attractive stocks like the two above.

There are thousands of stocks to choose from, but only a small percentage of that group are the right stocks for you to own. The best high-yield stocks need to have safe long-term businesses that print money every year no matter what the market does. Those are the only companies that can pay consistent dividends.

That’s a tall task for most companies, and unless you have a degree in finance or worked on Wall Street, picking the best companies to own, out of all of the other ones, is an extremely difficult task.

That’s why Tim Plaehn started his income letter, The Dividend Hunter, which uses his Monthly Dividend Paycheck Calendar tool that helps investors start earning a reliable income stream from dividend paychecks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

This unique tool will set you up to receive a more predictable dividend stock income stream that you can count on every month instead of just once a quarter like most other investors. Joining my calendar by Tuesday, July 18th will give you the opportunity to claim an extra $1,492 in dividend payouts by July 28th.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, July 18th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $1,492 in payouts by July 28th, but only if you’re on the list before July 18th. Click here to find out more about this unique, easy way of collecting monthly dividends.