7 Stocks to Buy in Wall Street’s Hottest Industry

This article was originally published on this site

As you can see from the current battle between Intel Corporation (NASDAQ:INTC) and Qualcomm Inc (NASDAQ:QCOM), or the meteoric rise of Nvidia Corporation (NASDAQ:NVDA), there are a lot of stocks to buy in the semiconductor space once again.

A large amount of the movement has to do with companies inside and outside the tech industry preparing for the next iteration of computer-based systems, as well as the massive amount of embedded systems that will be coming to market.

Embedded systems simply means equipment that has processing power embedded inside, but its main function is not primarily computing. For example, a new car is a machine to move us from one place to another, but inside the car are tire sensors, temperature sensors, GPS, warning sensors, etc.

So as virtual reality (VR) and augmented reality (AR) change our world — as well as the Internet of Things (IoT) and Big Data — it’s time to look for the ground floor opportunities. The big semiconductor companies aren’t the way to go. Now is when you look to the suppliers.

Below are the seven stocks to buy in Wall Street’s hottest industry that are just breaking out in this long-term trend.

Hottest Stocks to Buy: Lam Research (LRCX)

Lam Research Corporation (NASDAQ:LRCX) makes, designs and rebuilds semiconductor processing systems for companies in the tech and semi sectors. Basically, if a consumer company wants to move into a growing sector like artificial intelligence (AI), it orders equipment from a tech firm. That tech firm then orders some of those products from LRCX, or gives the company its overflow.

It is a key player in the semiconductor industry, but is not a name you would come across in any of the devices it’s involved in helping build.

Some of its biggest customers are DRAM and NAND memory chip makers. These are the memory chips that make up almost all the memory on portable devices and in smart machines.

In just the first quarter of 2017, semi equipment sales were $13 billion, that’s an increase of 58% compared to the year-ago quarter. That makes LCRX’s 50% rise year to date seem almost reasonable.

Hottest Stocks to Buy: MKS Instruments (MKSI)

MKS Instruments, Inc. (NASDAQ:MKSI) makes the advanced processes involved in making chips and circuit boards and other high-tech modern processes. Because what it does is not easy to explain to your average investor, it has fortunately not been a part of the secular rally in chip stocks. Don’t get me wrong, it’s up 47% year-to-date and it’s trading just below its 52-week high.

But given the massive transformation of demand its clients are experiencing, those are measured gains at this point. Remember, MKSI has been around since the early 1960s, so its client base is enormous and its reputation is well-known.

When the chip makers look for equipment, they look to MKSI.

Hottest Stocks to Buy: Advanced Energy (AEIS)

Advanced Energy Industries Inc (NASDAQ:AEIS) is in the power conversion business. While that may sound pretty simple and rather like a 20th Century industry than a 21st Century industry, you have to realize that power is more than alternating and direct current. It’s also radio frequency (RF) power for mobile communications equipment and plasma gas activity for screen technologies.

So it’s a crucial part of our mobile society, as well as all the glowing screens that are everywhere in our lives today. AEIS also plays a very important part in the renewable energy industry.

Power comes from wind and solar as DC and needs to be converted to AC and uploaded to the house or grid at a certain voltage. AEIS products make that happen.

Up 57% year to date, there’s still plenty of growth out there for AEIS.

Hottest Stocks to Buy: Nova Measuring (NVMI)

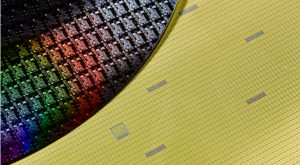

Nova Measuring Instruments Ltd. (NASDAQ:NVMI) is all about metrology, or as its name implies, measuring. When it comes to fabricating chips and boards and wafers, there is nothing more important than making sure the tiniest details are correct.

As processors and memory chips become increasingly faster, they necessarily become smaller and those measurements are now down to nanometers, or one billionth of a meter, or 0.000000001 m. And the metrology has to be exact, every time, for every piece of equipment.

According to the research group Gartner, the semiconductor industry should hit $364 billion in revenue 2017.

That’s big business. NVMI’s market cap is about $760 million now. That leaves it plenty of headroom, even after its 83% run year to date.

Hottest Stocks to Buy: Axcelis Tech (ACLS)

Axcelis Technologies Inc (NASDAQ:ACLS) provides equipment and services to the global semiconductor manufacturing industry. And it’s done so for the past 35 years.

One of the most significant themes that has been ever present in component technology is the fact that miniaturization is the never-ending goal. And that remains the case today.

If it’s faster, smarter mobile phones and equipment that are continually adding more features and more powerful applications, or if it’s creating the realistic virtual and augmented reality experiences you can, it’s all about being able to access information in memory and get it processed in real time, with as little delay as possible.

ACLS has one of the few technologies that allows these things to happen. Up 60% in the past three months, ACLS is just starting its run.

Hottest Stocks to Buy: Kulicke and Soffa (KLIC)

Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is a key player in the semiconductor manufacturing equipment sector.

This is without a doubt one of the biggest “make hay while the sun shines” market sectors there is. That is to say, it’s highly cyclical. But considering that caveat, there is a big green light flashing in the sector right now. And there’s no doubt KLIC will be a major beneficiary.

While its current performance — up 35% year to date — seems significant, the fact is, semiconductor demand has been in a multi-year slump. So what this performance shows is the sector is back in growth mode once again.

KLIC has put together two consecutive impressive quarters and that means we can expect a multi-year expansion in the sector with KLIC as a big winner.

Hottest Stocks to Buy: Camtek (CAMT)

Camtek LTD. (NASDAQ:CAMT) develops and builds inspection and metrology systems that support the global semiconductor industry. When you build chips, printed circuit boards and integrated circuits, you are building on incredibly small scales. Just as you would quality inspect cars that roll off the assembly line, you do the same for the brains and muscle inside chip sets and circuit boards.

And when the semi industry is hot, it’s churning out an ever greater amount of this equipment, which means CAMT is selling the equipment and services to support the chipmakers.

At a mere $186 million market cap CAMT is a small player in this sector but it has some unique capabilities that are helping it gain traction. It’s a grower on its own — up 70% year to date — but it’s also an interesting takeover play for bigger rivals.

Louis Navellier is a renowned growth investor. He is the editor of five investing newsletters: Blue Chip Growth, Emerging Growth, Ultimate Growth, Family Trust and Platinum Growth. His most popular service, Blue Chip Growth, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.