A U.S. Stock Market Crash Is Imminent Despite Fed’s Rosy Outlook

This article was originally published on this site

By , ,

A U.S. stock market crash is imminent, despite the Fed’s best attempts to convince you otherwise.U.S. markets are at all-time highs, but they won’t be able to sustain them much longer. The Fed keeps teasing another interest rate hike before the end of 2016, even though the economy is not healthy enough to raise rates.

In fact, Fed Chair Janet Yellen had been contemplating negative interest rates as recently as February. Even considering negative interest rates that recently is a clear sign of the unhealthy state of the U.S. economy.

And when things get ugly, many investors will be left unprepared.

That’s why we’re providing Money Morning readers with the best investment today that not only protects portfolios, but also profits during a U.S. stock market crash.

Before we get to the pick, here’s a breakdown of what’s really going on with the economy compared to what the Fed is trying to sell…

The U.S. Stock Market Crash: Fiction vs. Facts

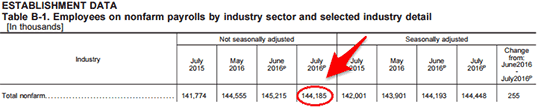

The Fed’s optimism is fueled mainly by the July U.S. jobs report. Analysts expected 180,000 jobs, but 255,000 new jobs were created.

That’s 41% higher than what was expected.

That sounds great, but here’s the truth: The Bureau of Labor Statistics (BLS) has a crafty way of making job growth look better than it actually is.

Before 1959, the BLS included just raw job additions to its monthly reports.

Trending: This U.S. Bank Is About to Relive the 2008 Derivatives Nightmare

Because those numbers didn’t always look great, the BLS created something called “seasonal adjustments.” Seasonal adjustments include jobs that are lost due to students going back to school, people being laid off after holiday shopping seasons, and weather issues preventing people from working in industries like construction.

So when you look at the raw data, it’s shocking to see what’s really going on.

In June, the BSL reported non-seasonal adjusted jobs of 145 million. In July, it was just 144 million.

That means American workers lost over 1 million jobs from June to July.

So how was there job growth when over 1 million jobs were lost? The BLS conveniently used seasonal adjustments to make job growth look better than it was. So instead of a loss of 1 million jobs, crafty math makes it seem like 255,000 jobs were created.

These misleading numbers make retail investors think everything is fine, when the markets are actually in trouble. And that’s how we get blindsided by a U.S. stock market crash.

Poor job growth isn’t the only issue the U.S. economy is facing right now. Here are two other reasons a U.S. stock market crash is imminent…

Two Major Reasons a U.S. Stock Market Crash Is Near

Secondly, wage growth in the United States is nonexistent. According to the BLS, real average weekly earnings in July 2015 were $364.29. In July 2016, they were $369.56. That’s a measly increase of just 1.4%.

“The hard truth is millions of American families are living paycheck to paycheck,”Money Morning Chief Investment Strategist Keith Fitz-Gerald said on Aug. 19. “The economic ‘recovery’ that the Fed and legions of economists are so proud of having engineered doesn’t exist – and hasn’t for a very long time.”

Fitz-Gerald also said that median household income is lower than it was in 2000, and incomes have grown by less than inflation in 28 states since 2007.

“Long story short: Many families are earning less than they did 16 years ago,” Fitz-Gerald said.

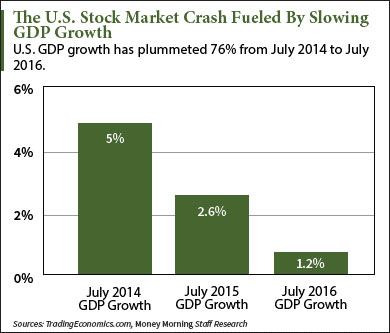

Finally, the Fed is also ignoring the fact that GDP growth has plummeted over the past three years.GDP growth is important because it measures the health of an economy by either how much employees and businesses make (known as GDP (I)), or by total consumption, government spending, investments, and net exports.

From July 2014 to July 2016, GDP growth has fallen 76%.

The question isn’t if the U.S. stock market will crash. It’s when.

But you don’t need to panic. By adding this one investment to your portfolio, you can still protect your portfolio and even profit during a U.S. stock market crash…

Before the U.S. Stock Market Crash, Buy This One Investment

Money Morning Global Credit Strategist Michael Lewitt recommends owning ProShares Short S&P 500 ETF (NYSE Arca: SH) in preparation for a U.S. stock market crash.

You see, SH is a bet against the S&P 500. This is an inverse exchange-traded fund (ETF) that climbs every time the S&P 500 falls. Think of it like “shorting” the S&P 500.

But unlike complicated options trading, you can purchase SH just like a regular stock.

It’s true that shares of SH are down 9% so far in 2016, compared to the S&P 500 climbing 7.3%. That’s due to global indices trading at all-time highs over the last several weeks.

Warning: This looks like the setup for a bond bloodbath…

But when the S&P 500 was down 4.4% because of market volatility from January to February, SH was up 4.7%.

And during a U.S. stock market crash, you can expect even bigger gains…

During the 2008 U.S. financial crash, SH traded for as high as $97.08 per share. If the market crashed and SH climbed like it did in 2008, from today’s opening price of $37.83 you could make a profit of 156%.

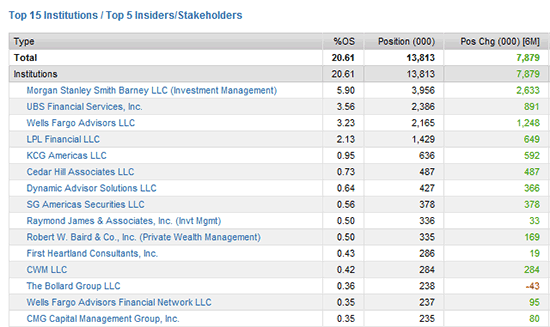

To hedge their portfolios against losses and still make profits, some of the biggest wealth advisory groups and advisory firms for banks own SH. And as you can see below, 14 out of the top 15 institutional holders have all increased their positions in SH over the last six months.

But because SH only goes up when the S&P 500 goes down, you only want to allocate a small portion of SH shares to your overall portfolio. SH does not offer a dividend, and it only climbs when the markets are volatile.

The Bottom Line: A U.S. stock market crash is imminent, despite the Fed’s best efforts to make retail investors believe otherwise. Lost jobs, average weekly earnings for workers barely climbing, and GDP growth plummeting over the past three years show the true health of the economy. By purchasing shares of SH, you will profit every time the S&P 500 falls. If SH trades at its peak during the 2008 financial crash, you could profit by as much as 156%.