Forget Google – This is the Best Advertising Stock to Buy Right Now

This article was originally published on this site

On Monday, analysts downgraded Alphabet Inc. (GOOGL) from a “buy” to a “hold” following the YouTube ad placement controversy. And with an evergrowing list of major marketing companies joining the boycott against the leader of U.S. digital ad revenues – it’s no surprise that investors are worried right now.

But here’s the thing…

Google’s not the only advertising stock out there to put your money on. Quite the opposite, actually…

There’s another stock that’s been flying under investors’ radars, so to speak…

It’s gained 134.29% in the past 12 weeks alone.

And it’s one of the most undervalued advertising stocks in the game…

It’s Time to Put Your Money on the Digital Advertising World’s “Little Guy”

U.S. digital advertising is currently a $40.9 billion industry, with analysts projecting more than double the revenue – $83 billion – this year. That’s why the current controversy Google is facing seems to be – on the surface – a devastating blow to the market.

But as I said above, Google’s not the only advertising stock out there.

Rocket Fuel Inc. (FUEL) is the leading provider of digital advertising solutions for digital marketing campaigns based in Redwood City, CA. It also provides services in Canada, the United Kingdom, Australia, France, Germany, Italy, Spain, and Sweden. It’s a fairly newer company, founded in 2008, and uses real-time data and artificial intelligence to anticipate consumer’s needs to improve marketing across digital media.

Although it’s still a “baby” in the industry, its future is very promising. In fact, just this week, the company announced their expanded partnership with IBM for the creation of a new capability, “Brand Moments,” which will integrate IBM Watson Discovery technology to detect brand sentiment in online news as a means to inform consumer purchase decisions. It’s AI, (artificial intelligence), software accomplishes a great deal for their clients. You can read more about their latest technological accomplishments at www.rocketfuel.com.

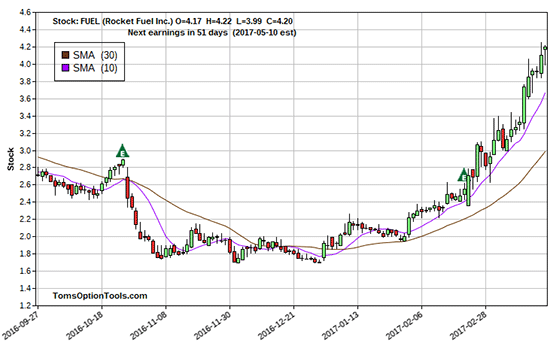

Now the last four earnings reports have been less than stellar for FUEL – but the stock has already gained 134.29% in the last 12 weeks, with a one-year return of 28.49%. Furthermore, it’s expected to grow 921.86% in revenue over the next five years.

And this week, it hit its 52-week high…

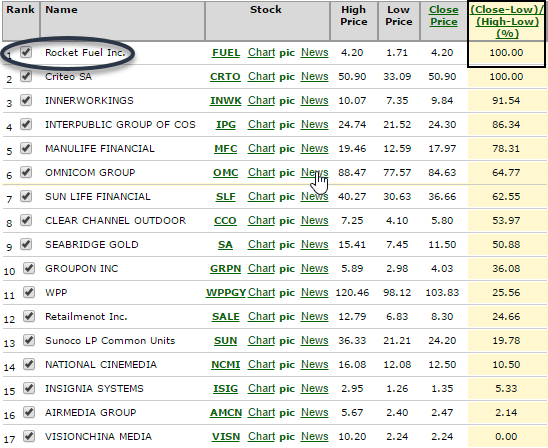

Above is a list of advertising companies currently at their 52-week highs, which I compiled using my proprietary tools. As you can see, FUEL holds the number one spot (notice that GOOGL isn’t even on the list).

It may not have that long of a tenure in the game and isn’t trading as high, per share, as other advertising companies, but it’s certainly on the rise and could become the leading challenger to advertising veterans. Just take a look at the stock’s momentum…

Thanks to it’s $4.20 share price, it’s not quite a wallet buster – but you could also play FUEL by using Longterm AnticiPation Securities (LEAPS). You could also use a calendar spread as way to leverage your dollars.

And of course, talk to your broker, Certified Public Accountant (CPA), or financial professional about the suitability for your portfolio.

Good trading,

Tom Gentile