Grab These Apple Supplier Stocks Now

This article was originally published on this site

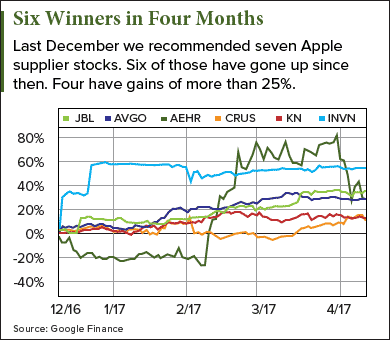

Readers of Money Morning who acted on the Apple supplier stocks recommendations I made just four months ago have made as much as 55%.

On Dec. 7, I shared seven Apple supplier stocks I thought would outperform broader markets. Each of these stocks had a high exposure to Apple – that is, a large percentage of their business comes from supplying Apple.

My expectation was that as the hype over the upcoming iPhone 8 began to build, forecasts of blockbuster iPhone sales would follow. Because this year is the 10th anniversary of the iPhone, the new models are expected to have at least one gotta-have-it feature that will spur a tremendous wave of upgrades.

The anticipation of a big sales boost from the iPhone 8 has helped push Apple stock to new all-time highs in recent weeks.

But I knew that as Wall Street came to realize how those higher sales also would boost the biggest Apple suppliers, their stock prices would rise as well.

The biggest winner was InvenSense Inc. (NYSE: INVN), which is up a little more than 55% since I shared those suppliers with readers on Dec. 7.

INVN stock jumped just days after that article appeared on rumors that Japanese electronics company TDK Corp. was in talks to buy InvenSense.

The rumors proved to be true. TDK announced Dec. 21 its intentions to buy InvenSense for $13 a share, or $1.3 billion.

There was some luck involved in that pick – a major acquisition deal is a quick road to profits – but of the seven Apple Inc. (Nasdaq: AAPL) suppliers I recommended in December, six are in positive territory. Four (including INVN) are up more than 25%.

Today I’ve got two more Apple supplier stock picks for you. First let’s take a look at each of December’s other winners.

How Our Apple Supplier Stock Picks Have Performed

- Jabil Circuit Inc. (NYSE: JBL): Jabil makes iPhone casings and tends to be sensitive to Apple/iPhone news. Since Dec. 7, it’s up about 35%. JBL stock has risen steadily over the past four months as talk of the iPhone 8 “supercycle” has ramped up. Jabil is also seeing growth from its non-Apple customers, which means this stock should continue to rise.

- Broadcom Ltd. (Nasdaq: AVGO): Broadcom stock is up 27% since Dec. 7. It makes the chips the iPhone needs for wireless communications. In February, an analyst for JPMorgan suggested Broadcom and Apple are collaborating on wireless charging technology, which could be a future catalyst for AVGO stock. And just two weeks ago we got more good news on the Apple-Broadcom front: the companies signed a three-year deal. That ensures Broadcom’s chips will be featured in the iPhone for at least the next few product cycles.

- AEHR Test Systems (Nasdaq: AEHR): Apple is AEHR’s largest customer; it tests the chips used in the iPhone. Over the past four months AEHR stock is up more than 25%. New features in the iPhone 8 will require new chips, which means more business for AEHR. Like Jabil, AEHR stock shows promise for continued gains.

- Knowles Corp. (NYSE: KN): Knowles stock is up about 13%. The company makes specialty microphones that go into the iPhone. Its tech helps make Siri possible. In addition to the extra sales the iPhone 8 will bring, Knowles is ideally positioned to gain business from the spread of voice assistant tech, such as Amazon.com Inc.’s (Nasdaq: AMZN) Alexa.

- Cirrus Logic Inc. (Nasdaq: CRUS): CRUS stock is up about 12% over the past four months. This company is one of the most dependent on Apple, with two-thirds of its business reliant on the tech giant. While Cirrus stands to get a big boost from the iPhone 8 in the year ahead, some analysts suspect that Samsung has included its noise-cancelling tech in the headphones for the Galaxy S8.

- Glu Mobile Inc. (Nasdaq: GLUU): Glu is the only stock in the group that has declined since we took a close look at these Apple suppliers. It’s down about 3.5%. While not a supplier per se, Glu develops games and other apps for the iOS system that runs the iPhone and the iPad. Half its business comes from iOS products. Unlike the chip suppliers, GLUU won’t see any benefit from the iPhone 8 until after customers buy it and start buying apps for their shiny new toy. Expect Glu stock to be higher by early 2018.

Now here are the two Apple supplier stocks I promised you – one for investors who want a “safe” bet and a riskier one for investors looking for maximum gains…

Two Apple Supplier Stocks to Buy Now

The first stock I have is a longtime Apple supplier, Micron Technology Inc. (Nasdaq: MU). Micron is best known for its memory products. It owns brands like Crucial, Lexar, and Ballistix.

Micron is one of the largest memory manufacturers in the world, ranking third for DRAM products and fourth for NAND flash memory.

Micron is “safer” than the Apple suppliers listed above because only a small portion of its business depends on Apple. But a surge in sales from the iPhone 8 will give Micron a boost.

“The most significant and strongest growth driver for this year’s memory chip makers is the 10th anniversary of the iPhone range, while last year Chinese smartphone makers drove the growth,” Sean Yang, an analyst at Taipei-based research firm DRAMeXchange, told the Nikkei Asian Review last week.

MU stock has been on a great run – it’s up more than 150% over the past year – but rising demand for memory is expected to keep Micron very busy over the next couple of years.

That’s because Micron supplies not just makers of mobile devices like Apple, but also companies building out their cloud services. In fact, sales are growing at an astounding rate.

In its most recent quarter, Micron reported a year-over-year sales increase of 58%. For the current quarter, Micron is expected to report a year-over-year sales increase of 86%.

According to Morningstar, the company’s five-year growth forecast is 110.2%. (The five-year forecast for fellow chipmaker Intel Corp. [Nasdaq: INTC] is just 5.3%.)

And while the trailing price-to-earnings ratio is a bit high at 47, the forward P/E is just 6.4.

According to FactSet, the one-year consensus price target on Micron stock is $39.04 – a gain of more than 44% from the current MU price of about $27.

A High-Risk, High-Reward Apple Supplier

The other stock I’m looking at – Energous Corp. (Nasdaq: WATT) – is a moonshot pick. If it takes off, you could do much more than double or triple your money.

Energous is a small, 75-person company that specializes in wireless charging technology. That means its transmitters can send a charge to your smartphone or tablet from a distance – eventually up to 15 feet.

The company has hinted that it’s working with Apple, and one of the rumored features of the iPhone 8 does happen to be wireless charging. If Apple indeed chooses to use the Energous technology, the stock will skyrocket.

But wireless charging may not be ready for the iPhone. And even if Apple is planning on putting wireless charging in a future iPhone, Energous may not end up being the supplier. Recall that other wireless charging rumors have linked Apple and Broadcom.

Still, the potential of the company’s technology has piqued the interest of analysts. Even without Apple as a customer, Energous could make waves in the consumer tech sector. Eight of them raised their price targets following the most recent Energous earnings report on March 23.

According to FactSet, the consensus one-year price target on WATT is $22.93 – more than 50% the current price of just under $15 a share. But it’s the long-term earnings estimates that caught my eye.

For 2019, the forecast is for earnings to shoot up to $7.90 a share. Assuming even a low P/E of 10, that’s a stock price of $79 – triple the current price.

This is clearly a high-risk, high-reward play, so don’t bet the farm on it. But a small investment could pay off big.