Stocks could predict who wins White House

This article was originally published on this site

Adam Shell, USA TODAY

History says a key ally of Hillary Clinton heading into Election Day could be the Wall Street bull. Donald Trump, on the other hand, might get his best endorsement from Wall Street’s dreaded bear.

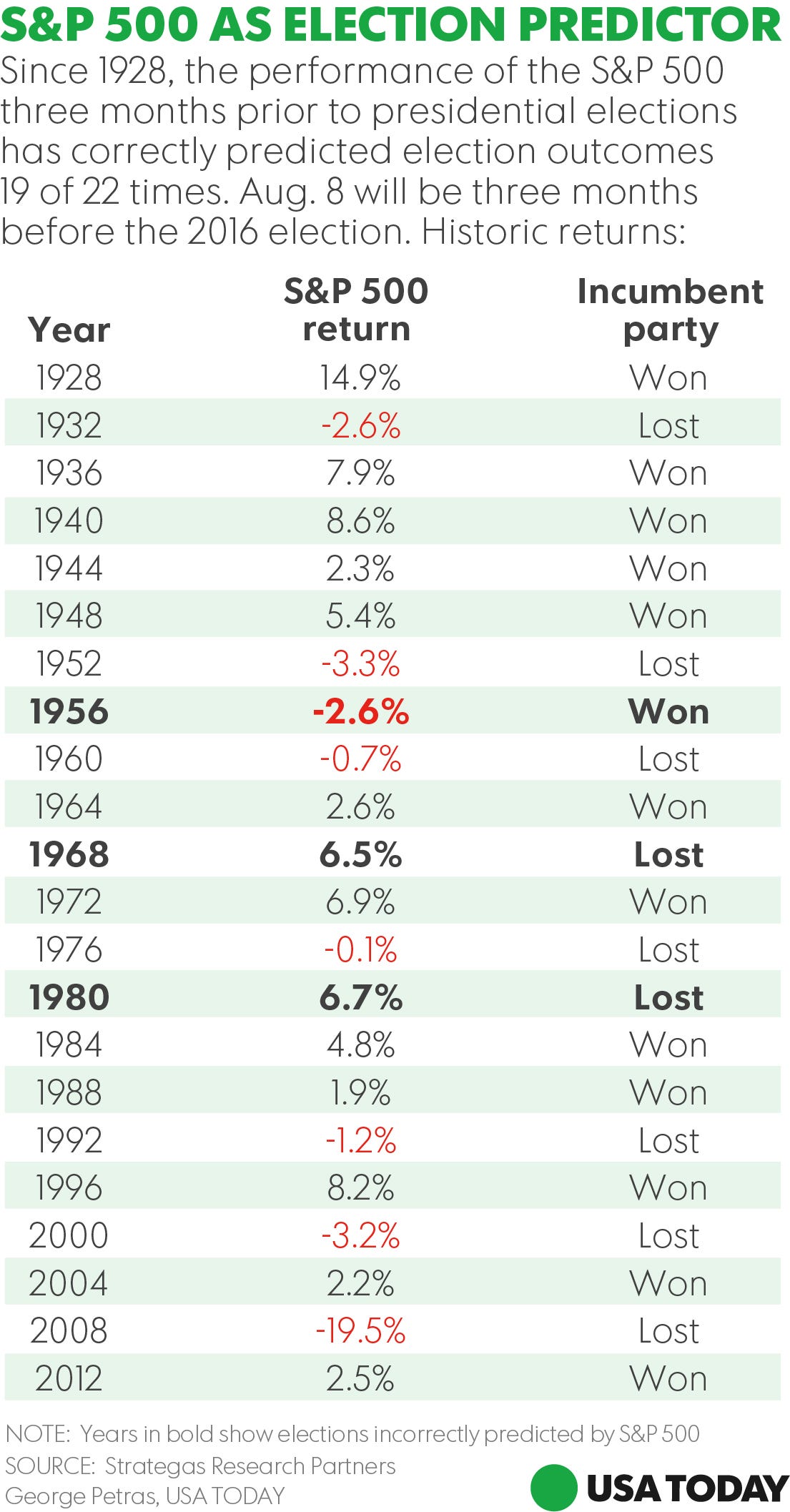

Here’s why: How the Standard & Poor’s 500 stock index performs in the three months before the November presidential election often determines who wins. The predictive power of the market in presidential politics, it turns out, is quite high.

If the stock market posts gains in the three-month run-up to Election Day, the candidate from the political party already in the White House has a very high probability of winning. In contrast, the party trying to retake the Oval Office has a better shot if stocks tumble in the 90 days before the votes are cast.

| Ready for 300% returns? Volatile markets like this offer incredible opportunities for options traders. Join two experts as they demonstrate how to create winning options strategies by harnessing market volatility. Click here for the Free Course |

Using that road map, stocks have correctly predicted the winner of 19 of the past 22 (or 86%) presidential elections since 1928 — and eight straight elections since 1984, according to data compiled by Strategas Research Partners. Back in 2008 during the financial crisis, for example, a 19.5% plunge for the S&P 500 in that key three-month span under Republican president George W. Bush doomed the candidacy of John McCain, paving the way for Democrat Barack Obama to win the White House.

Just as the incumbent party benefits from a strong economy, so too does a strong stock market help their cause.

Says Quincy Krosby, market strategist at Prudential Financial: “A stronger stock market confirms strength in the economy, and if the incumbent party is perceived as positive for the economic landscape, it typically leads to an election win.”

“The stock market,” adds Bill Stone, chief investment strategist at PNC Asset Management, “could be considered something of a referendum on the incumbent party.”

Stone also acknowledges that the stock market “could serve as a crude polling device given that a rising stock market also impacts household wealth.”

This year, however, the stock market could hold less sway in the election than in the past, argues Jim Paulsen, chief investment strategist at Wells Capital Management. Stocks’ running to new highs this year doesn’t necessarily match the more downbeat view of the economy held by many Americans. What’s more, he adds, the economy isn’t necessarily the No. 1 issue driving the campaign.

“The economy is probably not the ‘primary’ issue today,” Paulsen told USA TODAY. “It seems as though other issues like disgust with government, Washington or anti-establishment issues may be more important.”

“Past elections” Paulsen adds, “have not had as much international fears — ISIS, Brexit, Iran nukes, Russia relations, etc. — as this one does, which again may reduce the impact of the stock market indicator.”