The 2 Best Small-Cap Stocks to Buy Now

This article was originally published on this site

Today Money Morning Small-Cap Specialist Sid Riggs gives us two of the best small-cap stocks to buy this year. Shares of these two companies could hand investors huge double-digit returns over the next 12 months.

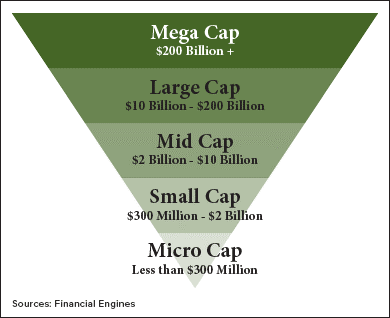

A small-cap stock has a market cap between about $300 million and $2 billion. What makes these stocks so enticing to investors is their often low share prices paired with high growth potential. A $6 stock in a flourishing industry could potentially double your money faster than a larger, established company with a stock trading around $40 a share.

Just look at what the small-cap-focused Russell 2000 did around the election. During the early phases of the “Trump rally” from Nov. 4, 2016, through Nov. 25, the small-cap benchmark soared 16.4%. During the same time, the Dow climbed just 6.8%.

What’s even better about investing in the right small caps is how most fund managers are restricted by the SEC from buying huge positions in small-cap companies.

In other words, small caps give retail investors the chance to beat institutional investors at their own game. You can buy shares before Wall Street – and then enjoy the share-price growth once the big guys finally pour money into these stocks.

Because of these explosive gains, many investors use the terms “small-cap stocks” and “penny stocks” interchangeably. After all, both indicate investments with small market caps and generally high volatility.

But there’s one major difference that makes the right small-cap stocks – including the two we’re recommending today – safer than most penny stocks…

The Difference Between Small-Cap Stocks and Penny Stocks

The biggest difference between the two is their price limits.

You see, penny stocks and small-cap stocks are similar in that both can have low market caps and can trade on major exchanges like the Nasdaq and New York Stock Exchange. But a stock is only considered a penny stock if it trades below $5 a share.

On the other hand, a small-cap stock can have a price higher than $5 a share. The only qualification for a small-cap stock is the company must have a market cap between $300 million and $2 billion, though that range can vary by brokerage. You can calculate a company’s market cap by multiplying the number of outstanding shares by the stock price.

If a stock trades below $5 a share, it often indicates the stock has very low liquidity. That means penny stocks are riskier because they have larger bid-ask spreads, meaning they can’t be bought and sold very quickly.

There are healthier penny stocks on the market that we keep an eye on for investors – in fact, you can get one of those here, courtesy of Money Morning Chief Investment Strategist Keith Fitz-Gerald.

The two small-cap stocks we’re recommending today are less risky than many small caps. Shares of these companies cost more than double the typical penny stock cutoff of $5. However, Riggs believes they’re more than worth the extra money.

Here are two of the best stocks to buy right now…

The Best Small-Cap Stocks to Buy for 26% and 53.8% Returns by April 2018

Intevac makes sensor-based technology used across several growing industries, including solar energy, digital media, and defense. For example, its sensors are used in military-grade night-vision goggles as well as professional camera equipment. Both the media and defense industries are expected to see tremendous growth this year, especially the latter if Trump’s plan to boost military spending by $54 billion comes through.

However, the real industry to watch is solar energy. Intevac is a big provider of sensors used in solar panels. That’s good for business since the number of solar panel installations this year is projected to rise 88.1% to 410 megawatts.

All of this is bullish for the IVAC stock price. Analysts surveyed by Yahoo Finance say shares could climb as much as 26% from their current $11.90 level to $15 by next April.

Riggs’ second small-cap stock pick – VASCO Data Security International Inc. (Nasdaq: VDSI) – could soar even higher. Those same analysts think it could rally 53.8% from $13 a share right now to $20 in the next 12 months.

Riggs loves VASCO because it taps into a high-growth niche industry: financial cybersecurity.

He projects about 2 billion people worldwide will use mobile devices for banking transactions by 2019. That means there could be as many as 285.7 million mobile transactions every day by then if each person performs at least one transaction per week.

“That comes out to 11.9 million transactions an hour,” Riggs said. “That’s a whole lot of opportunities for hackers to intercept your banking information as it travels through ‘secure’ networks.”

Surging volumes of mobile transactions will be a huge long-term catalyst for VDSI stock. The company makes encryption technology for digital banking, with services ranging from electronic signatures to mobile app security. VASCO has more than 10,000 customers across several important industries, such as healthcare, government, and banking.

As mobile banking keeps growing, the VDSI stock price will grow alongside it. That’s why analysts see a 53.8% gain by April 2018.

With small caps continuing to outperform the broader stock market, IVAC and VDSI are undoubtedly the best ways to play the rally.