The Best Stocks to Buy Now: Six New Picks from Our Experts

This article was originally published on this site

Sometimes great stock picks come in pairs. That’s why for this round of the best stocks to buy now we’ll be giving you two ways to play each profitable trend our investing experts have highlighted.

Next, we’ll talk about the home services market, which appears to be immune to the Retail Ice Age. A new merger in this market gives investors two entrances as the industry moves online.

Finally, U.S. President Donald Trump’s Paris Agreement exit has some people worried about the future of renewable energy. But the action in Europe and Asia is as hot as ever, and we’ll tell you two companies that stand to benefit.

Let’s take a look at our new list of the best stocks to buy now.

Best Stocks to Buy Now: Two Ways to Play This $100 Billion Money-Minting Machine

Imagine watching one of your investments surge by 40% in the blink of an eye.

That’s what happened in May to Paytm, India’s largest electronic payment company. The reason? The world’s largest private equity fund had just pumped $1.4 billion into it, bringing Paytm’s total value to $7 billion.

That $1.4 billion is a drop in the bucket. The private equity fund just closed with $93 billion in initial commitments and aims to reach $100 billion over the next six months. Backers include heavy hitters such as Apple Inc. (Nasdaq: AAPL) and Qualcomm Inc. (Nasdaq: QCOM).

It’s called the “Vision Fund,” and it comes from Japanese telecommunications giant SoftBank Group Corp. (OTCMKTS: SFTBY).

Softbank is run by Masayoshi Son, who has made a name for himself funding tech startups since the 1990s. Back in 2000, he injected $20 million into a small Chinese e-commerce company founded by an English teacher. That company was Alibaba Holding Group Ltd. (NYSE: BABA), now known as the Amazon of China, and Son’s stake is estimated to be worth over $100 billion.

Thanks to that and other wildly successful investments, money tends to follow Son wherever he goes. His investments in ride-sharing service Didi Chuxing and WeWork Cos. Inc. pushed valuations up immediately.

That gives us two plays on Softbank’s Vision Fund.

First, you can invest in Softbank to benefit from Son’s Midas touch. Money Morning Chief Investment Strategist Keith Fitz-Gerald says Son’s track record speaks for itself. “There is little doubt in my mind that you’ve got a legacy holding on your hands” if you invest in Softbank, he told readers in May.

Second, you can jump out in front of this development by investing in the kinds of companies the Vision Fund will be attracted to. The key here is that you don’t need to pick stocks that Son and his team actually end up investing in. That would be great, but the Vision Fund is so large and Son’s gravitational field so wide that investors are going to end up shelling out more money for tech startups across the board. So being exposed to a variety of up-and-coming companies early in their development is a great way to cash in on the Vision Fund’s impact.

For that, it’s hard to beat the Fidelity Contrafund (MUTF: FCNTX), which holds positions in pre-IPO startups such as Airbnb, Dropbox, and Pinterest. Formed in the 1960s and tasked with finding undervalued companies, the Contrafund combines the excitement of ground-floor investing with the stability of a growth fund. $10,000 invested in 2007 would be worth just under $23,000 today. With all the money in the market looking for a home, there’s every reason to believe the fund’s stellar performance will continue.

Best Stocks to Buy Now: The Online Revolution Is Snatching Up Retail’s Most Bulletproof Sector

While the Retail Ice Age is amassing an impressive body count among brick-and-mortar retail stores, the home services sector continues to thrive. Home Depot Co.’s (NYSE: HD) first-quarter earnings were up 16% from the previous year and 44% from two years earlier. The numbers for Lowe’s Co. Inc. (NYSE: LOW) are even more impressive, at 18% and 47% respectively.

But that doesn’t mean the online revolution isn’t taking over home services. As more and more millennials are becoming homeowners, they are increasingly looking online to find contract professionals such as plumbers, electricians, and painters. And two major players in that online market are about to join forces.

In May, New York-based IAC/InterActiveCorp (Nasdaq: IAC) announced it would buy Angie’s List Inc. (Nasdaq: ANGI) in a deal that will close later this year. IAC will be combining Angie’s List with its HomeAdvisor service under the name ANGI Homeservices Inc.

Angie’s List was a major innovator in connecting homeowners with service professionals. It currently has over 5 million members and 55,000 professionals. The deal will give ANGI Homeservices a combined 22 million monthly visitors and 211,000 professionals.

Still, the vast majority of the home services market remains offline, and no company has yet emerged as the Google or Amazon of the marketplace. The merger gives ANGI a big leg up in that race.

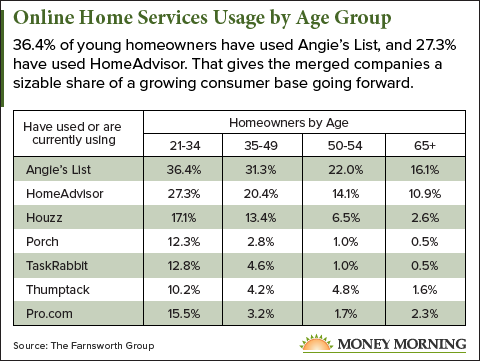

A 2016 report by the Farnsworth Group showed that 36.4% of home services consumers age 21 to 34 had used Angie’s List while 27.3% had used Home Advisor. The numbers trail off for older consumers, but obviously the market landscape is shifting.

And as online services take a bigger slice of the pie, the pie will continue to grow. A 2017 report from Technavio predicted a compound annual growth rate of 49% in the home services market over the next four years.

Now, the two ways to play this development…

First, you can buy shares in IAC. That gives you a whole slew of enterprises beyond home services, including Ask.com, CollegeHumor, Match.com, and The Daily Beast. But it will own 87% to 90% of ANGI Homeservices if you want to capitalize on that growth.

Second, you can invest directly in ANGI Homeservices. Shares won’t hit the market until later this year, but shareholders of Angie’s List will have the choice of receiving shares in the new company. (The other option is to take the $8.50 per share buyout.) That puts you in the most direct position to benefit from the growing online market for home services.

Best Stocks to Buy Now: These Two Overseas Companies Will Reap Energy Profits After the Paris Agreement Exit

President Trump’s decision to pull out of the Paris Climate Agreement may have generated headlines, but it didn’t have much impact in the stock market.

That’s probably because it doesn’t change much.

First of all, it will take four years to exit the agreement. Second, all the provisions were voluntary, and the United States was not meeting its goals anyway. So it’s hard to point to any trend that will be dramatically reversed by the decision.

But one effect of the withdrawal is that it signals to the world – and to the markets – that America is not the place to look for the clean energy revolution. Instead, that’s going to happen overseas, especially in China and Europe.

At the EU-China Summit in June, leaders on both sides reaffirmed their commitment to the Paris Agreement and singled out renewable energy as a key area of cooperation.

Of course, renewable energy in the United States is not going to grind to a halt. For one thing, as much as Trump might hope, coal power is not making a comeback. It’s simply too expensive. And for another, there’s still plenty of support for renewable energy among American businesses and local governments.

Nonetheless, for those trying to invest in renewable energy, China and Europe are the places to look.

Once again, that gives us two great ways to play this trend.

First, let’s look at the global leader in wind energy. That’s Denmark’s Vestas Wind Systems AS (OTCMKTS ADR: VWDRY). Vestas installed 43% of all wind power plants in the United States in 2016. And as the focus shifts overseas, Vestas is ideally positioned to grow its business. In March the company announced a major deal in China, which as the world’s No. 1 consumer of energy is set to expand its use of wind energy significantly in the coming years.

Second, solar energy is set to expand in a big way. That’s going to be a boost for China’s JinkoSolar Holding Co. Ltd. (NYSE: JKS). In June it was reported that Jinko was the first company to ship more than 2GW worth of solar modules in a single quarter. Now it’s aiming for more than 2.5GW in the second quarter. If that happens, Jinko will equal 2015’s full output in just the first six months of 2017.

The best news about solar energy is that it’s becoming cheaper all the time. So even ignoring the environmental, governments and businesses have plenty of reason to make the switch to solar. As Money Morning Global Energy Strategist Dr. Kent Moors puts it, “With global operations and good relations with the Chinese government – where solar power capacity equivalent to more than 30 nuclear reactors was installed last year – Jinko is perfectly positioned to continue growing and rewarding shareholders savvy enough to spot that fact.”