The One Sector You Must Own In 2017

This article was originally published on this site

First, please notice I said in 2017. While we are nibbling at this sector now, unlike most prognosticators, I believe we are likely to see one more downswing this year. If I’m wrong, we still own a little. If I’m right, we will own a lot more.

I’m talking about a re-entry into the natural gas and oil business. Why do I think we may be able to add to our positions at even cheaper prices?

First, because Saudi Arabia just effectively admitted they made a huge mistake trying to drive U.S. and Canadian firms out of the gas and oil business. Their $400 billion mistake happened because they were looking backward, not forward. The simply didn’t understand both the rate of cost-cutting technological advances made in horizontal fracturing and oil sands mining, nor did they realize how tough and resourceful our wildcatters are.

As a result, they have had to roll over now and allow Iran to pump more gas and oil, and they have provided the same privilege to Nigeria and Libya. OPEC is in shambles. I wrote an article for a foreign relations venue titled “OPEC: Dead Man Walking.” The energy markets are 100% about supply and demand today and no cartel can control such a force.

Right now, there is still a smidge too much supply, with more continuing to come on-stream, and too little demand, globally or in the US. But as long as cartels and governments are ineffective or distracted, Adam Smith’s Invisible Hand is at play in the gas and oil sector just as it is everywhere else.

The euphoria over the head-fake supply constraint deal reached in Algiers? It will be forgotten as each and every OPEC member cheats on their allotment. So in the short term I see supply as greater than demand, and that is why I am only nibbling at the stocks of companies that make their living from selling gas and oil.

But over time? Again, the equation is remarkably simple, as is the case for owning gas and oil companies and their suppliers and contractors: more bodies on earth = more motor scooters, more cars, more factories, and more travel = greater demand. Greater… than the supply.

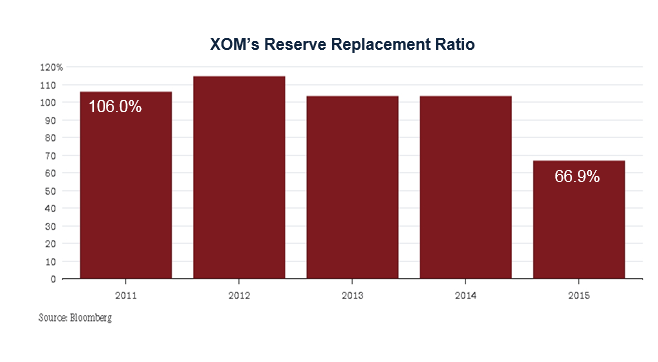

I also see bargains developing more fully as the “reserve replacement” numbers are released shortly after year-end. The SEC dictates that the average of the previous year’s month-end prices be used when a company defines its “proven reserves.” And proven reserves only count those reserves that are economically retrievable at that snapshot in time. This makes sense. Claiming a trillion barrels of oil is meaningless if it would cost $10,000 a barrel to get them out of the ground. As investors see what seems to be decreasing proven reserves, I think they will panic and drive quality gas and oil firms down one more time.

For instance, seeing a chart like the one below would make most people believe Exxon (NYSE:XOM) is depleting its reserves. Not so – it’s merely showing that proven reserves (those that are economical at today’s prices) have declined for now. At a higher price, they will increase again:

All along, the physical resource is still there — and the cost of getting it out of the ground is coming down every year as explorers, producers, drillers, suppliers and refiners use new technologies to reduce extraction and distribution costs. To me, these reserves are like money in the bank that is tied up for some short-term reason. Better technologies will allow them to be freed up once again. The gas and oil companies that lazy journalists claim “…are depleting their reserves! They don’t really have the reserves they said they did!” will prove these Chicken Littles wrong. The gas and oil firms can’t claim it in their current reporting since, at today’s prices, it isn’t economically viable. But it’s still there. And more valuable as prices begin to stabilize based on new demand.

As an annual percentage increase, of course, demand is growing less quickly than it did before 2007-2008. But it is still growing. And it is increasing ever more quickly in India, the fastest-growing country in the world (where, unlike China, we can likely trust their growth numbers!) as well as in many other emerging markets. Want to grow your nation? You’ll need gas and oil. For transportation. For infrastructure products. For plastics. For chemicals. For heating and air-conditioning. As the world grows, gas and oil demand grow.

Energy consultant Wood McKenzie recently concluded that big elephant hunts are being replaced by what just happens to be our favorite approach: more gas than oil, more unconventional extraction like oil sands, advances in horizontal fracturing technologies and, my favorite of all since we do the hard research on up-and-coming gas and oil firms, via acquisitions. That’s why ’m looking to buy in what I think will be a valley of opportunity in the coming weeks and months. Alternatives may someday rule but today the electric vehicles that are all the rage still run on lithium or electricity. Lithium batteries, like almost every product on earth, take energy to produce. Electricity takes, mostly, gas, coal or oil to produce.

It is a good thing that people care about the flora and fauna that inhabit this earth as we strive to find cleaner sources of energy. But there are as yet no ideal solutions; only intelligent discourse. That is why I see natural gas, the cleanest of all non-renewables, as the most obvious short-to-intermediate term investment choice.

In the real world, the poorest of nations primarily use biomass. Regrettably, burning wood, cow dung, brush and other biomass is not particularly healthy for them or the environment. Hydropower has just about reached its limits, at least using current technologies. Most major rivers in the world have been dammed for electricity and water storage. Those that remain are still open because of geopolitical disagreement and may stay that way. Nuclear is clean and efficient but terrifies too many people to be depended upon to meet future requirements. Solar and wind have stalled in numerous locations, either because of significantly higher expense or failure to provide steady energy.

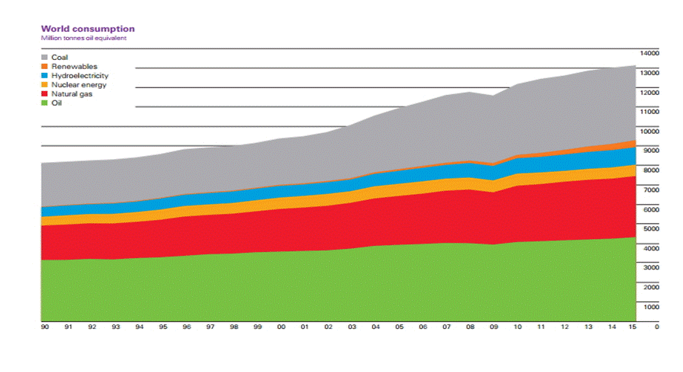

So here is where we stand as of now: despite the War on Coal, it is still the most used source of energy around the globe. Oil is barely increasing in usage, but natural gas is starting to take off:

That leaves coal, oil and natural gas as the 3 biggest contributors to a world seeking more and more energy. I consider all of them to be “batteries:” Nature’s Batteries, if you will. They are the result of eons of birth, life and death. In that sense they, too, are biomass — in its most concentrated form. Markets will fluctuate; these three do not march in lockstep. But as long as they are relatively close to each other in price for each BTU of energy produced, I believe most rational people (and the occasional rational government, if such a thing exists) will opt for the cleanest fuel they can depend upon to be available in sufficient quantity for their use. And that fuel is natural gas, by a country mile.

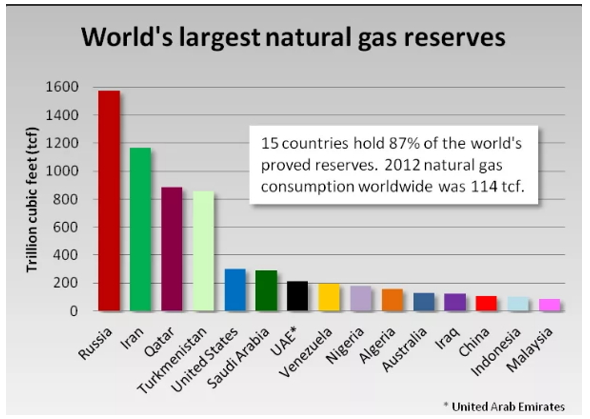

Most charts you find on the Internet are outdated before they are posted. Worse, most of them are undated, even when you do the sleuthing to find where it was originally published. The one below is as close to accurate as I can determine by cross-checking numerous reliable sources but, by itself, it doesn’t begin to tell the whole story. For instance, you might look at the exceptionally high amount of natural gas reserves in Russia and conclude you’d best rush out and buy Gazprom (MCX:GAZP), (OTC:GZPFY).

However, what you might want to know, before you do, is that half of those reserves are located in Western Siberia and another quarter are in the Kara and Barents Seas above the Arctic Circle. I’ve been to that part of the world and I can assure you it isn’t going to be cheap to get that gas! Even the Russian submarine base at Murmansk is inoperable for much of the year and building more gas production facilities will not be as high a priority.

On the other hand the failure of the EU to get the Nabucco pipeline project going (with gas from Azerbaijan and Turkmenistan) may yet make Arctic and Siberian gas the only alternative for much of Europe.Then of course, in considering Gazprom, one must always consider the viciousness, xenophobia or, being kinder, the capriciousness of the current Russian leadership.

Numbers 2 and 3 in reserves, Iran and Qatar, are a whole ‘nuther story. I count myself as one of those in the geopolitical intelligence community completely befuddled by the recent decision to lift sanctions on the world’s #1 state sponsor of terrorism. The Iranian regime was on the ropes; all we had to do was let them fall. A large plurality of the Iranian people, by and large, are disgusted with the theocracy they live under and would relish the opportunity to rejoin the world community. Maybe that day will come but until it does I imagine even the canny Persians will have difficulty getting others to trust them as their first supplier of choice. Especially when Qatar, just across the gulf a few miles, has been courting Europe for years and is more accommodating by an order of magnitude.

I’ve only skimmed the surface of the possible geopolitical and economic issues; there are scores more. Which is why I plan to stick, globally, with US and European gas and oil majors for whom a renege by Russia, a revolution in Iran, or a snit in Turkmenistan would only affect part of their production and earnings. And since liquid oil can be easily transported but gas must be liquefied or pipelined, I am particularly fond of US, Canadian and Mexican gas companies. As the Founding Fathers might say, we are blessed by Providence to inhabit the continent we do and have the neighbors we have.

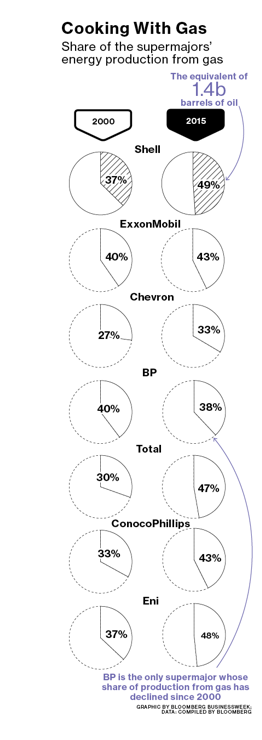

So, for the best global exposure, I include the chart above. You’ll note the smartest kids on the block, over the past 15 years, have been moving more and more into natural gas. Exxon (XOM) bought XTO for $41 billion in 2010, Shell (NYSE:RDSb) bought BG Group for $70 billion in 2016, and all the other major players have been moving in the same direction.

Just as Gazprom is building Nord Stream 2 to push Russian gas to Germany and beyond, the US has approved liquefied natural gas (LNG) exports so Exxon, Chevron (NYSE:CVX) and every other US major and virtually every other US gas company, can effectively compete with Gazprom by delivering gas to the newly built LNG terminals in Poland and Lithuania.

What to Buy, What to Buy

Among the global giants, my favorites are XOM, France’s Total (NYSE:TOT), CVX, and RDS-B which, despite some dreadful decisions to pursue elephant Arctic fields as oil prices plunged, seems to have snapped back nicely. Exxon has operations on every continent but Antarctica, but more and more, they are producing oil overseas and gas in the USA; about 2/3 of its domestic reserves are now in gas.

At one time or another, all 4 of these have been in our portfolio. I don’t yet have a purchase price in mind; that will depend on (a) if I’m correct and there will be another retracement this year and (b) what I see at the time in the way of the best price. We want the best companies, yes, and I believe these 4 should top the list. But if they hold like a rock and Conoco (NYSE:COP) or Occidental (NYSE:OXY) plunge, I’d have to consider them as the more attractive purchase at the time.

Now for the next tier in terms of deep pockets, the right acreage and a successful history of turning exploration into production is of utmost importance. It takes billions of dollars today to stay in this business. A company needs deep pockets to withstand the occasional run of exploratory bad luck in order to reap the rewards of successful discovery down the road. Unlike XOM, TOT, CVX and RDS-B, all of which pay dividends that pay way better than CDs or money market funds and raise those dividends regularly, these firms tend to reinvest their earnings into more production.

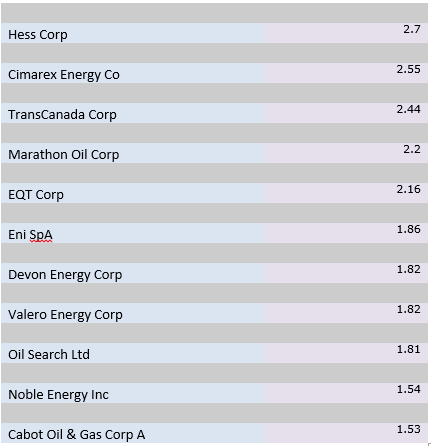

I think the best of the best, at the right price, include our former portfolio holdings Range Resources (NYSE:RRC), Encana (NYSE:ECA), Cenovus (NYSE:CVE), Texas Pacific Land (NYSE:TPL) and Antero Resources (NYSE:AR), as well as Canadian Natural Resources (NYSE:CNQ), Anadarko Petroleum (NYSE:APC), Southwestern Energy (NYSE:SWN) and Devon Energy (NYSE:DVN). I’ve already written about the ones we’ve previously held in our portfolio so I’ll take this opportunity to briefly discuss CNQ, APC, DVN and SWN.

Canadian Natural Resources just became the largest natural gas producer in Canada — and that means they are bigger than some very heavy hitters. They’ve done so by acquiring both wells and acreage from competitors who were anxious sellers during the oil and gas summer swoon a few months ago. Including the 2000 wells they also bought from almost-major ConocoPhillips (NYSE:COP), CNQ now has more than 53,000 wells just in Alberta.

Because of the scale of its operations, CNQ now has a production portfolio served by some 40,000 miles of pipelines from wellhead to storage and points of sale. Coincidentally, these purchases have made CNQ the largest private owner of land in all of western Canada. CNQ is sitting on a gold mine, or at least the natural gas, natural gas liquids and oil equivalent. As for value, it is currently priced for perfection, or at least as if gas and oil prices will stay the same or increase from here. I won’t buy today but I’ll keep it on the first page of our Watchlist. At $32 with a 2.2% yield, not yet. But at $25 I’ll nibble and at $22 I’ll take a nice bite.

Anadarko is one of the biggest independent gas and oil producers in the US, with additional exploration and production in Africa, South America, Asia and New Zealand. Worldwide, natural gas makes up only about half of Anadarko’s reserves, but about 90% of the new wells it drilled in the US in 2015 were gas wells.

Ever opportunistic, APC announced on September 12 that it had entered into a purchase agreement with Freeport McMoRan (NYSE:FCX) for a huge chunk of FCX’s deepwater Gulf of Mexico holdings. This is the way it works; one company overextends itself in the good times, then sells assets for less than they paid to smarter operators in the bad times. We’ll begin disciplined buying in the $42-$48 range.

Devon is an independent driller that sticks mostly to properties in the US and Canada. More than 90% of Devon’s U.S. reserves are in natural gas, with most of that in the Barnett Shale in Texas. DVN has been among the most aggressive of all E&P firms in slashing costs early, a move that has allowed them to operate profitable even with today’s current low prices. If I am correct and gas and oil prices decline in the coming weeks, strong as DVN is in the Permian Basin, it too will decline. I’ll be a happy buyer between $28 and $33.

Southwestern is another independent driller that focuses exclusively on natural gas. The company has operations in Arkansas, Texas, Oklahoma and Pennsylvania, with the biggest chunk of its production coming from the Fayetteville Shale. I think SWN’s stock will revisit single digits in a decline. Anytime it goes below $10 — which is really close right now — we’ll be waiting!

Finally, for those who just can’t wait, you might want to take a position in BlackRock Energy and Resources Trust (NYSE:BGR). If I’m correct and gas and oil prices decline once more, BGR will decline as well. But at least this closed-end fund (CEF) sells at the mid-range of its 52-week discount, at -8.43%.

But be careful! With closed-end funds, as investor sentiment fades, the discount often widens, so the CEF can have greater leverage on the downside. The opposite is true on the upside of course so if it declines I’ll bite the bullet and add to my position as the discount widens. If that event never occurs, I have a portfolio, at an 8% discount, that may lose or lessen the discount and will follow the prices of a really nice gas and oil company portfolio.

Disclaimer: I do not know your personal financial situation, so this is not “personalized” investment advice. I encourage you to do your own due diligence on issues I discuss to see if they might be of value in your own investing.

Past performance is no guarantee of future results. Our many years of success might have been just dumb luck. Often, my articles expand upon recent communiqués to our clients. If you wish further information regarding our services, please contact us at inquire@stanfordwealth.com – or contact me directly at joe@stanfordwealth.com.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SHO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.