Why 2017 is Forecast to be a Banner Year for Stocks

This article was originally published on this site

Wall Street’s top stock market strategists are telling clients that the S&P 500 will reach new all-time highs in 2017, fueled by accelerating earnings growth.

“We predict adjusted earnings per share for the S&P 500 will grow 7% in 2017 to $127,” Barclays’ Jonathan Glionna said on Tuesday. “This would be the strongest EPS growth since 2014.”

RBC’s Jonathan Golub communicated a similar forecast to clients on Monday.

Glionna, Golub and their peers are modeling their expectations for an economy run by Donald Trump and his Republican Congress, which apparently comes with more good than bad for corporate America. (Yahoo Finance’s Myles Udland offered a close look at one of these bullish forces last week.)

In a nutshell, the unfavorable effects of a stronger dollar, higher wages and rising input costs are expected to be more than offset by nominal GDP growth, which combines both real growth with inflation.

“We interpret the US election outcome with a Republican sweep as pro-growth for equities,” JP Morgan’s Dubravko Lakos-Bujas said. “Expectations of decreased regulation, favorable tax reform, increased fiscal spending, and less congressional gridlock should drive stronger revenue growth and higher net income margins. Further, the removal of election uncertainty and some form of cash repatriation should result in increased investment activity.”

Further fueled by inflows from underinvested investors, the S&P 500 could reach 2,300 “by early next year,” Lakos-Bujas said.

The S&P touched its current all-time high of 2,193 on August 15.

Morgan Stanley’s Adam Parker is a bit more skeptical, but he still offers a scenario that gets the market to all-time highs.

“Our view is that more uncertainty and more fundamental volatility is likely, and that historically these elements were greeted with lower multiples and more cautious risk-taking,” Parker said on Monday. “Our bias is to get long gridlock and uncertainty relative to what has been priced in. That being said, our base case remains mid-single-digit upside to the S&P500 on a 12-month basis.”

A mid-single digit return from today’s levels sends the S&P to around 2,280, a record high.

Earnings growth is key

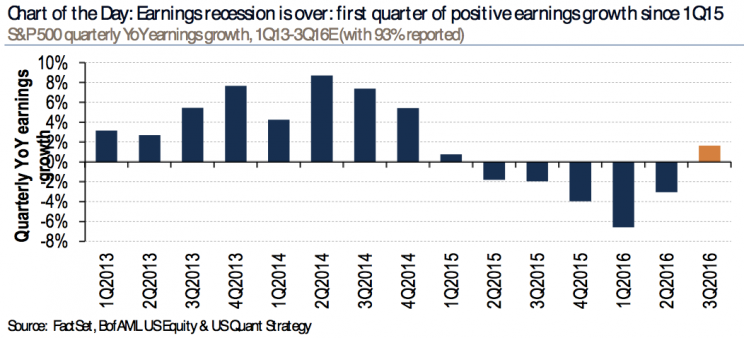

Over the past five years, stock prices have outpaced earnings growth which has caused valuations to stretch to above-average levels. This has been exacerbated by the fact that earnings have been in recession for five consecutive quarters.

But now that earnings recession seems to be a thing of the past.

“S&P 500 3Q earnings have come in 5% better than analysts expected, leading to the 1st positive quarter for EPS growth since 1Q15,” Bank of America Merrill Lynch Savita Subramanian observed on Tuesday. “We expect growth will continue to recover in the coming quarters.”

Subramanian sees S&P EPS growing 7% to $125 in 2017. She has yet to publish her 2017 target for the S&P (but she sees it going to 3,500 by 2025).

“Equity markets are primarily driven by earnings,” Citi’s Tobias Levkovich argues.

In April, Levkovich forecasted the S&P could hit 2,250 by mid-2017, and in September he said it could hit 2,325 by the end of 2017. On Friday, he added that “additional gains are reasonable in the next 12-15 months but not outstanding.”

It’s worth noting that not everyone is so optimistic. Goldman Sachs’ David Kostin expects the S&P to slide to 2,100 this year before topping out at around 2,200 in 2017.

We expect more strategists on Wall Street to unveil their outlooks for 2017 over the next few weeks. Stay tuned.