3 Cheap Buy-Rated Tech Stocks with Big Growth

Investors love technology stocks, as their rapid growth and market momentum are undeniably attractive.

Still, many point to the high valuations commonly found within these stocks, steering away those with a value-conscious approach. And with the sector’s massive run over the last year, many feel that technology stocks have gotten a bit rich.

However, several stocks from the Zacks Computer and Technology sector – Qualcomm (QCOM – Free Report) , StoneCo (STNE – Free Report) , and OSI Systems (OSIS – Free Report) – all carry impressive growth expectations paired with sound valuations.

Let’s take a closer look at each for those seeking a blend of value and growth.

Qualcomm

Qualcomm, a current Zacks Rank #2 (Buy), designs, manufactures, and markets digital wireless telecom products and services based on the Code Division Multiple Access (CDMA) technology. Consensus expectations for its current year suggest 13% earnings growth on 5% higher sales, with earnings expectations drifting higher across several timeframes.

Image Source: Zacks Investment Research

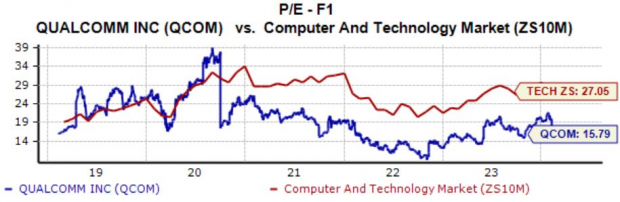

Shares presently trade at a 15.8X forward earnings multiple (F1), well beneath the 19.4X five-year median and highs of 38.5X in 2020. The value compares favorably to the Zacks Computer and Technology sector average of 27.1X.

Image Source: Zacks Investment Research

QCOM shares offer technology exposure paired with a passive income stream, currently yielding a respectable 2.2% annually. The company’s operational abilities have allowed it to grow the payout nicely, sporting a 6.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

QCOM shares have underperformed over the last year, adding 16% compared to the S&P 500’s 25% gain.

StoneCo

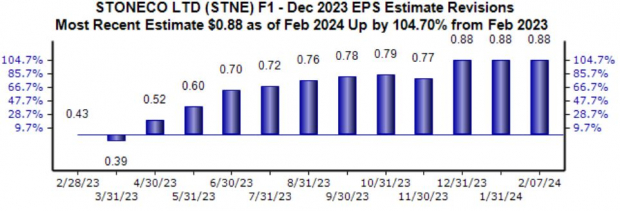

StoneCo, a current Zacks Rank #1 (Strong Buy), offers an end-to-end cloud-based technology platform to conduct electronic commerce across in-store, online, and mobile channels. The revisions trend for its current fiscal year has been notably bullish, with the Zacks Consensus EPS estimate up 105% to $0.88 per share.

Image Source: Zacks Investment Research

The company’s growth profile stands out, as consensus expectations for its current fiscal year imply 170% earnings growth paired with a 10% sales uptick. STNE’s top line growth has seen an acceleration over the last few years, as illustrated below.

Image Source: Zacks Investment Research

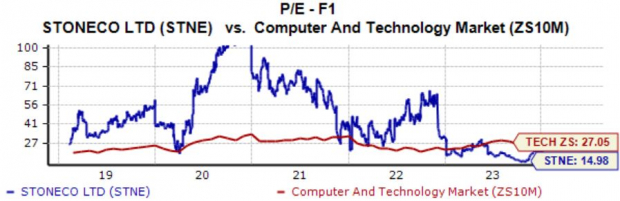

The valuation picture remains sound, with the current 14.9X forward earnings multiple (F1) nicely beneath the steep 42.4X five-year median and the respective Zacks sector average. Over the last five years, shares have traded as high as 140.2X in 2020.

Image Source: Zacks Investment Research

STNE shares have been big-time performers over the last year, up more than 80% and boosted by better-than-expected quarterly results.

OSI Systems

OSI Systems, a current Zacks Rank #2 (Buy), is a vertically integrated designer and manufacturer of specialized electronic systems and components for critical applications in the homeland security, healthcare, defense, and aerospace industries.

Like STNE, analysts have shown positivity surrounding its current year (FY24) outlook, with the current $8.03 Zacks Consensus EPS estimate up 16% over the last year and suggesting 30% year-over-year growth. Sales growth is also prevalent, expected to grow by 20% in FY24.

Image Source: Zacks Investment Research

Valuation isn’t rich considering the expected growth, with the current 16.3X forward earnings multiple (F1) modestly beneath the 16.8X five-year median and five-year highs of 27.7X in 2019. The stock sports a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

Shares have had a strong showing over the last year, gaining nearly 45% and outperforming relative to the S&P 500.

Bottom Line

Tech stocks have consistently been a favorite in the market, as their momentum and growth are difficult to ignore. However, some point to their high valuations, steering away potential investors who are looking for a ‘deal.’

For those seeking a blend of value and growth, all three technology stocks above – Qualcomm (QCOM – Free Report) , StoneCo (STNE – Free Report) , and OSI Systems (OSIS – Free Report) – fit the criteria nicely.

In addition, all three sport a favorable Zacks Rank, indicating optimism among analysts.

This article was originally published on this site