5 Ways To Buy A Stock That Will Make You Rich (Very Slowly)

This article was originally published on this site

Investors always come with the same question: Should I buy this stock?

The real question they should ask is: How should I buy this stock?

The way you invest matters more than what you are investing in.

To be able to fight analysis paralysis (fear) and FOMO (greed), there are five ways to buy a stock that can create outstanding safeguards.

If you apply these principles, I believe you are on your way to riches. That is, as long as you are willing to give it time.

I do much more than just articles at App Economy Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Investors spend a lot of time thinking about their selling strategy. They would be much better off focusing on their buying strategy.

The selling part should be extremely easy. Recently, I wrote a piece about The Art Of Not Selling. The article covers the power of compounding, Pareto, and looks back at decades of stock performance we can learn from. I made the case for the idea of being passively active via a “coffee can” portfolio approach focused on quality. It’s a simple concept that implies that you don’t sell unless you need the money or the original bullish thesis is broken.

Today, I want to focus on the other side of the transaction.

“The Art Of Buying,” if you will.

As someone leading an investing marketplace, I get questions from members every day that sound more or less like this:

- Should I buy this stock?

- Is this a good buy at this level?

- Would you still buy this stock today?

If you have found a fantastic company you are ready to add to your portfolio, the real question you should ask is not whether you should buy it, but how you should buy it.

If your buying strategy is executed properly for any investment opportunity you come across, you should be able to protect your portfolio from the common pitfalls that can adversely impact your returns.

Warren Buffett explains:

The most important quality for an investor is temperament, not intellect.

Investors have to constantly struggle with counter-intuitive emotions:

- They suffer from analysis paralysis (fear), which prevents them from buying a stock and keeps them at bay.

- They suffer from FOMO (greed), which makes them buy too much at once, right when the opportunity is sub-optimal.

By using a system that protects you from your own flaws, you’ll give yourself much greater odds of success.

Let’s cover the five ways to buy a stock that can help protect your portfolio from your own mistakes and give you a much more predictable path to riches over the long term.

1) Dollar Cost Averaging

When it comes to investing, you are your own worst enemy.

We are all driven by emotions and constantly fighting inner voices that can lead to underperformance. We are hardwired to be scared to buy when it would be most opportunistic and to be willing to bet the entire farm when it would be prudent to hold off.

A stock price movement is impossible to predict in the short term. I recommend you run away from any charlatan who tells you otherwise.

Dollar-cost averaging (or DCA for the rest of this article) is a favorite practice of Benjamin Graham, Warren Buffett’s mentor. It means investing a set dollar amount in the same investment at fixed intervals over time. This leads you to buy more shares when prices are low and fewer while prices are high.

Let’s go through a simple example, courtesy of Broadridge Advisor.

Let’s say a company’s stock price is:

- $30 a share in January

- $10 a share in February

- $20 a share in March

- $15 a share in April

- $25 a share in May

“If you invest $300 a month for 5 months, the number of shares you would buy each month would range from 10 shares when the price is at a peak of $30 to 30 shares when the price is only $10.”

You can see here an immediate benefit of DCA:

- “The average market price over five months is $20 a share ($30 + $10 + $20 + $15 + $25 = $100 divided by 5 = $20).

- However, because your $300 bought more shares at the lower share prices, the average purchase price is $17.24 ($300 x 5 months = $1,500 invested divided by 87 shares purchased = $17.24).”

The potential to lower your average cost per share is an obvious benefit of DCA, but it’s not the main one. Above all else, DCA is a method to:

- Remove your emotions from the equation.

- Guarantee a disciplined approach that will prevent you from going “all-in” at any given time, or to skip investing for months or years on end just because you believe that “the market is about to crash.”

- Make you buy low, since DCA involves that you will buy more shares when the price is low and less when the price is high.

- Most investors derive their available funds from their income stream. DCA can be very practical and automate the investing process in line with the way most investors generate savings. You may not realize this, but if you set up a monthly contribution to a retirement account, you are already dollar cost averaging. This is usually done via target date funds or broad market ETFs that follow the S&P 500 (SPY), emerging markets (VWO) or specific sectors such as REITs (VNQ) or the Nasdaq 100 (QQQ).

- Investors without a process will tend to panic in a market crash and sell their positions by convincing themselves that they need to “raise cash.” Building a position slowly over time is more likely to empower you to stay the course when the market inevitably suffers from volatility and large sell-offs of 10%, 20% or even 30% from previous highs like it did in March. With a DCA mentality, you are more likely to look forward to accumulating more shares when the market falls.

For years, many investors refused to invest in FANG stocks (Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOG)) because they couldn’t convince themselves to buy shares of companies that already had huge runs. The concepts of having “missed the boat” or that the “easy money has already been made” are incredibly pernicious in investing. DCA is the ultimate antidote, because it encourages one to start accumulating shares of great companies by going slow and steady.

I recently covered why I believe SMART stocks are the new FANG. And if you use DCA to build positions in the companies that represent the next wave of dominant technology companies, chances are that you will be very pleased with the results over the long term.

An important caveat here is that the long term is the only kind of term that will allow for such a strategy to succeed. Buying in small increments over weeks, months or years requires playing a very different game. A game that will not make you rich overnight.

2) Averaging Up

Any fear taken to an extreme can become extremely detrimental to your returns. For example, a traumatic experience can lead to unintentional learning and misguided conclusions. Investors who got traumatized in the dot.com bubble burst are still avoiding technology stocks even today, more than 20 years later.

Averaging up is the concept of adding to a position that has already appreciated. By doing so, you are driving up the average cost of your position by accumulating shares at a price that is higher than your previous purchase.

We are hardwired to avoid averaging up. The explanation is simple and rooted in acrophobia – the irrational fear of heights. Our fear of heights comes from the very natural fear of falling.

The fear of falling applies very much to the investing world. A stock that has risen a lot gives naturally the impression that it has more room to fall.

If you have found an outstanding investment opportunity and shares are appreciating over time, you have to be willing to fight your fear of averaging up in order to build a sizable position in a winner.

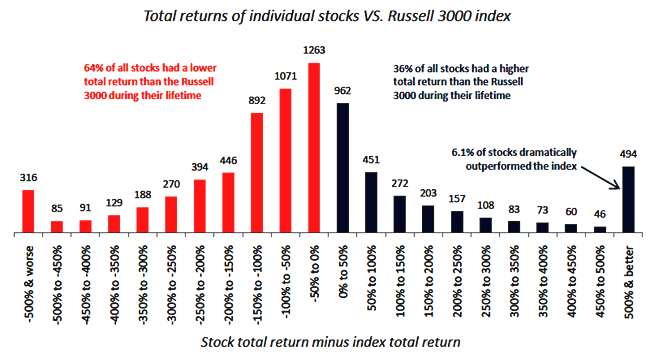

I have discussed before the idea that only 6% of stocks significantly outperformed the index (by 500% or more).

If you want to own and build sizable positions in the very best performers that are going to be the main source of alpha in your portfolio, you have to be willing to add to them over time.

Rather than focusing on your losers, you have to cherish your winners and realize that increasing your cost basis over time is a necessity if you want to increase your exposure to the best performers the market has to offer. What matters most is your overall portfolio performance, not the returns % of a specific position.

It goes without saying that the buying strategy of adding up should be applied with the delicate art of balancing diversification and concentration in mind.

3) Adding On Sell-Offs

I’ve covered before the beautiful art of adding to your winners with a company like MongoDB (MDB). More recently, I explained how I turned particularly bullish on Roku (ROKU) after a 44% sell-off.

In both cases, I was building positions in companies that presented two important characteristics:

- They are long-term winners and thriving businesses (companies that have outperformed the S&P 500 by a wide margin over the years and benefit from secular tailwinds).

- They had recently dipped significantly from their previous highs.

The combination of these two factors can be extremely powerful to generate alpha. But they have to come hand in hand.

It is essential to distinguish drawdowns that are likely to be temporary (such as broad market sell-offs, negative sentiment due to a short-term issue, “sell-the-news” events) from those that are likely to be permanent (impaired value of the business, dramatic shift in the competitive landscape, profound leadership challenges, loss of key customers, and so on).

Plenty of companies will fall out of favor for good reasons. The notion that adding on sell-offs is a good buying strategy should never constitute an excuse to buy shares of businesses that should be avoided to begin with. I discussed previously the “10 Reasons Not To Buy A Stock.” No sell-off should justify investing in such companies.

Now, let’s assume we are looking at a promising company that warrants a spot in your portfolio. Even the stocks of the very best businesses don’t go up in a straight line. They have temporary sell-offs that can be extreme over time. If you are looking at a company that has a strong track record of market outperformance alongside a consistent operating history, you are likely looking at a strong opportunity to accumulate shares whenever they dip significantly from their previous highs.

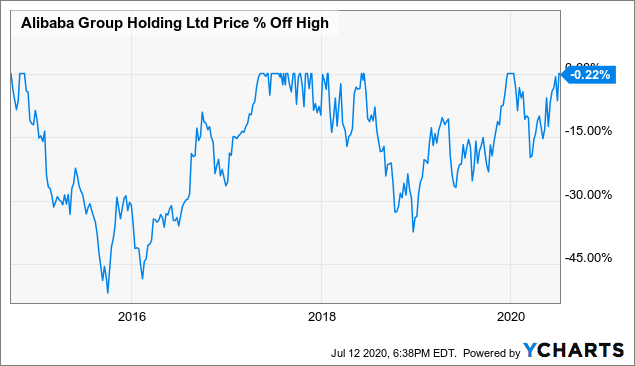

Look at a company like Alibaba (BABA). The stock has more than tripled the S&P 500 returns since going public in 2014. But you had opportunities to buy shares more than 30% down from their previous high multiple times since the IPO, creating extremely attractive entry points.

Using opportunistic entry points following large sell-offs combined with a DCA approach can be an incredible source of alpha, if you give it time.

Always keep in mind that many outstanding businesses can fall out of favor for several months, or even years, before rebounding to new highs. Long holding periods (several years) are essential for this strategy to deliver results.

4) Adding At A Lower Valuation

We addressed the fact that averaging up can be daunting. One of the mental models that can help is the concept of adding to a position at a lower valuation multiple.

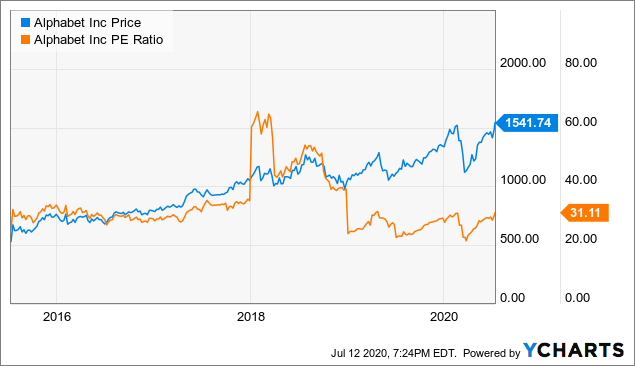

Let’s use the example of Alphabet (GOOG). If you bought shares of Alphabet in 2018, you did so at a price-to-earnings ratio that was above 40 at the time.

In this hypothetical scenario, shares have appreciated close to 50% since the beginning of 2018. But in the meantime, the company has greatly improved its profitability. As a result, the stock is currently trading at a P/E ratio of 31 as of this writing.

Accumulating more shares today would imply a higher price, but also a lower valuation multiple. In many ways, investing in Alphabet today as it trades above $1,500 could be considered less risky than buying shares when it was trading at $1,000 two years ago if we look at it from the prism of the P/E ratio.

The greatest companies improve their fundamentals over time, often more than justifying their stock price appreciation. By focusing on the improved valuation, you can increase your confidence in the prospects of the business and have the courage to add to your position.

I described previously the natural tendency for investors to suffer from anchoring. Focusing on the evolution of the valuation metrics can be a great way to alleviate the risk of anchoring based solely on stock price.

5) Dividend Reinvestment Plan

Another form of dollar cost averaging method that can create wonders for investors over the long term is a dividend reinvestment plan, also known by the acronym “DRIP.”

The way it works is extremely simple. If you enroll in a DRIP, the cash dividends you receive from a company are reinvested in that same company via an automatic purchase of fractional shares.

For example, a company like Apple (AAPL) has a forward dividend of $3.28 per share, which is a 0.85% yield as of this writing. If you enroll in a DRIP, you will receive a fraction of a share instead of a cash dividend payment for a value of $3.28 per share owned.

Many companies offer shares at a discount through their DRIP, which can create an opportunity to accumulate shares at a lower price automatically.

By enrolling in a DRIP, you are not only using DCA, but also likely averaging up if the shares of a company appreciate over time. And your emotions are out of the equation, since the plan is automated.

It might not sound like much, but reinvesting dividends can truly amplify your returns over the long term, due to the power of compounding. Your reinvested dividend will, in turn, generate dividends indeed.

To illustrate, Hartford Funds shows below the growth of $10,000 invested in the S&P 500 from 1960 to 2017 if you reinvest dividends. The difference is staggering.

Bottom Line

There are no easy ways to get rich quick. But there are many ways to do it slowly.

After all, to quote Warren Buffett one more time:

The stock market is a wonderfully efficient mechanism for transferring wealth from the impatient to the patient.

If you have a long time horizon, you can achieve tremendous success by following a methodical buying strategy, and then letting time be on your side and do the work for you.

Dollar cost averaging, averaging up, adding on sell-offs unrelated to the underlying business, adding at lower valuation multiples over time and enrolling in DRIPs are all fantastic ways to make you rich. As long as you are willing to give it the time it deserves.