Buy These 3 Stocks to Ride the Bitcoin Boom

This article was originally published on this site

For the longest time, Wall Street ignored the wild ‘party’ going on in the realm of cryptocurrencies and more specifically Bitcoin.

But no longer… Wall Street is joining in on the party and supplying some of the ‘booze’. That ‘booze’ is coming in the form of Bitcoin derivatives. On December 1, the Commodity Futures Trading Commission gave the green light to plans from the Chicago Board Options Exchange – owned by CBOE Global Markets (Nasdaq: CBOE) – and the CME Group (Nasdaq: CME) to begin trading Bitcoin futures. The CME announced trading will begin on December 18.

This is huge shift in attitude from Wall Street, where many of its leading executives had called Bitcoin nothing more than a ‘fraud’. This seeming endorsement now by Wall Street may be the beginning of a whole new asset class to invest into.

The reason for this change in attitude is obvious – Wall Street can ‘smell’ the money. Despite some very sharp reversals, Bitcoin has been on a very fast elevator ride upward, from little more than $300 at the start of 2015 to over $11,000 last week and settling just below that as I write this.

Despite all the headlines and the fact that Coinbase, the largest U.S. cryptocurrency exchange, now has more accounts than Charles Schwab, I suspect that many of them people chasing after Bitcoin don’t even know exactly what it is. If you fall into that category, here is a quick primer on cryptocurrencies and Bitcoin as well as three stocks to put in your portfolio to profit from the Bitcoin revolution.

What in the World Is Bitcoin?

Sometimes called coins, a cryptocurrency is a creation of the 21st century and is a mixture of digital assets, large computing power and a network of servers that store shared data. Besides Bitcoin, there are numerous other cryptocurrencies including Ethereum, Litecoin, Dash and Ripple. Ethereum, for example, is often used as the ‘money supply’ for initial coin offerings, or ICOs.

For simplicity’s sake, let me concentrate solely on Bitcoin. In basic terms, it is a cryptographically scarce and secure medium of exchange. In effect, it is a string of computer code. Each and every transaction is recorded in a database called a blockchain. This technology is accepted by even the Bitcoin naysayers as important.

I say scarce because there is only a finite number of Bitcoins – 21 million – that can be created through a process called mining (solving complex mathematical problems using powerful computers). In an interesting side note, the intensity of mining this year has used more electricity than the annual consumption by 159 nations, according to Digiconomist.

Data from Chainalysis reveals that there are currently only 16.7 million Bitcoins in circulation. Of those Bitcoins in circulation, about 37% have been spent or traded in the past year, another roughly 22% is being held by strategic investors, and the rest can be classified as ‘lost’. If you look at the valuation of Bitcoin, it is now approximately $170 billion, which is equivalent to the market capitalization of General Electric (NYSE: GE).

Because of meteoric rise, there are myths that have grown around Bitcoin, which I will now address.

Bitcoin Myths

Probably the number one myth is that Bitcoin can be hacked. That is false – Bitcoin has not been hacked.

But Bitcoin exchanges have been hacked. That means it’s up to you to keep your Bitcoin holdings secure from hackers. You’ll need to do due diligence research on finding the most secure digital wallets. The largest digital wallet company in the U.S. is Blockchain.com.

I would not keep my Bitcoin with the exchange you bought Bitcoin from. Not only is there the hacking risk, but if you keep it there my feeling is that you don’t own the Bitcoin, they do.

Another big myth is that Bitcoin really isn’t money. But it seems to me it is. I want you to think about some of the characteristics of money…

- Limited supply – Bitcoins are limited, while some paper currencies (like Zimbabwe) are not.

- Divisibility – Both dollars and Bitcoins can be broken up into smaller increments. Even though Bitcoin is trading at $10,000 you can buy $10 worth of it if you choose.

- Uniformity – a dollar is a dollar and a Bitcoin is a Bitcoin. That is unlike primitive currencies like seashells.

- Acceptability – U.S. dollars are accepted pretty much anywhere in the world. Bitcoin is not there yet, but that is changing. In April of this year, Japan passed a law stating that Bitcoin is acceptable as legal tender.

- Durability and Portability – think about how gold’s characteristics fit these criteria. Here is the one weakness Bitcoin has. What if a nuclear electromagnetic bomb knocks out electricity for months? It will be a little tough to access your Bitcoin wealth.

Despite that, it still may make sense to put a little of your speculative money into Bitcoin.

Bitcoin Investments

But if you’re a stock market-type investor, there is still no pure-play way to invest into Bitcoin since the SEC continues to drag its feet on approving Bitcoin ETFs. And the Bitcoin Investment Trust (OTC: GBTC) still sells at a huge premium to the underlying value of the Bitcoins it holds. As of December 1, GBTC traded at $1,666 – but the Bitcoins it holds were valued at only $932.63.

That leaves only companies that are involved with Bitcoin, but in a peripheral way. Here are a few of those stocks:

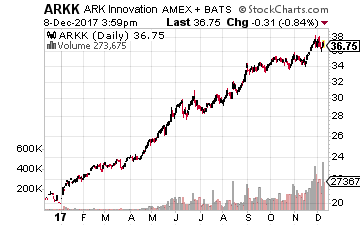

The ARKK ETF owns a position in the aforementioned Bitcoin Investment Trust. The Bitcoin Investment Trust is the number one position in its current 53 stock portfolio and it makes up 6.79% of the overall ARKK investment portfolio. In other words, any major selloff (noted short seller Andrew Left is short GBTC) won’t devastate the fund.

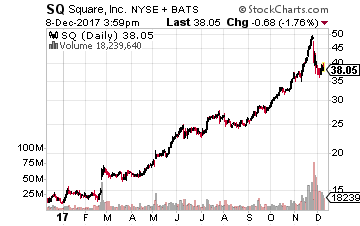

Square had already started to let its merchants accept Bitcoin as early as 2014. But the rocket to its share price was ignited when on November 15, Square permitted some of the users of its Square Cash app purchase Bitcoin. Square Cash allows customers to store money and send peer-to-peer payments without the use of a bank account.

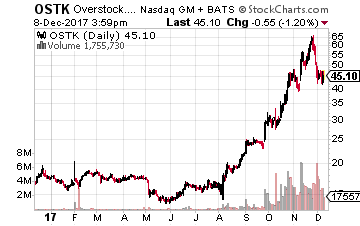

The shares got a turbo-boost (23%) on September 27, when the company announced plans for an exchange for trading digital currencies. The stock got a similar boost recently after plans for an initial coin offering (ICO) were unveiled. If the ICO is successful, through its tZero subsidiary, Overstock will be the first major public firm to do so. ICOs have raised an astonishing $3 billion this year.

I strongly suspect we will see more companies, such as Paypal (Nasdaq: PYPL), follow the Square path as Bitcoin becomes more mainstream, sending their stock skyward.