I Put Half Of My Retirement Savings Into These Investments

This article was originally published on this site

Half of the battle of investing and portfolio planning is knowing where to put your hard-earned money to work. As my frequent readers know, I demand that those investments I make will work just as hard as I do to produce income. I don’t give a single investment a pass on returning “cash back” to my portfolio on a regular and timely basis. Not all investments produce the same yield, that’s to be expected, but overall my portfolio yields +8%. Yours can too.

Think of a farmer’s orchard for a moment. Each tree can be expected to produce a certain amount of fruit, based on its genetics and type. So each tree could represent a specific pick in your portfolio. The types or species of trees you plant would be your allocations to different areas of your retirement portfolio. For example, apples are Energy, pears are Healthcare, cherries are Telecom stocks such as AT&T (T) (yield 6.9%), and other high yields. As such, you need to pay special attention to how many trees you plant in total, but also how many of each type of tree. Too many of any one species could expose your portfolio to additional risks. As an investor you have your work cut out for you, needing to stay aware of your portfolio, market conditions, and global situations.

Today I am going to share two areas that together make up half of my total portfolio. Each security in my portfolio is contained to a normalized 2% max allocation rule, which I use for diversification purposes, meaning that I do not allocate more than 2% of my funds to a single position.

I’ve Got 50% of My Retirement in Two Main Investments

Personally, I have 50% of my retirement in two areas that I see as stable for generating income and that offer opportunities for outperformance looking forward.

My retirement portfolio targets an overall yield of +9% which I share with members of my investment community through a simple, easy-to-follow “model portfolio”. I like to buy and hold stocks and securities for the long term. However, every investor has to adjust for factors such as changes in economic policies, government and political decisions, interest rate trends, and importantly, inflation risks.

Currently, my portfolio is heavily weighted in two areas. Why do only two main allocations make up 50% of my retirement savings?

- They produce reliable income streams.

- They provide additional clarity into the companies’ finances.

- They are anchored by external forces.

- They are able to generate income to beat the impact of future inflation.

40% Allocation to Fixed Income (With Inflation Protection):

Keeping a healthy allocation to fixed income is a must for income investors and retirees. “Immediate income” investing can often lead to more volatility in price, which we accept due to the higher immediate income provided to us. However, layering in a high level of fixed-income picks provides additional rigidity to your portfolio.

By buying preferred stocks and bonds, you climb higher in the capital stack. This means you are less likely to see price volatility in your portfolio and you can achieve a far safer income stream in the form of dividends and interest. Additionally, in the case of a market crash, they tend to be the first to recover, and the good ones recover very quickly.

Preferred stocks and baby bonds benefit from having par values that are also tied to their liquidation value. In most cases, the par value of a baby bond or preferred stock is $25 per share. So even in moments of extreme trading, an investor who’s holding for income knows they have an expected return of capital plus some gains at maturity.

Dividends provide a level of psychological benefit, as holders of fixed-income securities and other dividend-paying securities can see their dividends coming in and they lock in a return with each payment. Those who hold non-dividend-paying securities have to depend on the price alone to generate a return.

When it comes to fixed income, I especially like those that offer the opportunity for inflation protection down the road. This can often mean a future floating rate that can rise with interest rates.

- Global Partners LP 9.75% Series A Fixed/Float Cumulative Redeemable Perpetual Preferred Units (GLP.PA) fits this bill. Currently, it yields 9.3% and after August of 2023, it will begin to have a floating rate. This means that if interest rates have climbed due to inflation by then, GLP.PA will have the ability to rise with the tide. GLP.PA will become floating at 3-month Libor plus 6.77% in August 2023. I fully expect that by the year 2024 Libor rates (or their equivalent) will be well over 0.5%, and could hit as high as 2% in the following years. This means that GLP.PA could keep paying you as high as 9% when other preferred stocks that currently pay you could lose both their value and appeal. This is what I call a great hedge against both inflation and rising interest rates.

- Crestwood Equity Partners LP 9.25% Preferred Partnership Units (CEQP.PR) which currently yields 9.7%. I love this preferred stock because it is very unique. This is a “busted preferred stock” which cannot be called. I will explain why: CEQP.PR is non-callable but is convertible into common shares. The issuing company Crestwood Equity Partners (CEQP) is unable to convert CEQP.PR into common shares until their common share price exceeds $135 for 20 out of 30 trading days. Today CEQP’s shares are trading at around $27. This is why CEQP.PR is viewed as a “busted” convertible – CEQP cannot call it or redeem it, and until their common unit price rises astronomically, they cannot convert it. CEQP.PR offers a way to get an income stream for years to come, or possibly decades. If you buy today, you are locking in a yield of 9.7% on your cost for a very long time. I view the CEQP preferred as a good hedge against inflation because the higher the yield, the less you are impacted by inflation. It is highly unlikely that inflation will run remotely close to 9% with all the tools that the Fed has today. So you will almost certainly be beating inflation with this 9% yielder. Note that CEQP.PR issues a K-1 tax form.

Neither of these preferred stocks missed any payments throughout the crazy market of 2020. This is the kind of investment I look for in this area of my portfolio: Reliable. Dependable. Steady.

During the past few months, I have repositioned part of our portfolio from “term fixed income” to “floating-rate” fixed income in anticipation of inflation expectations and higher interest rates. These efforts have paid off. We will continue to build on this strategy as we fully expect that a “heating” (or even “overheating”) U.S. economy is underway, for the next 3 years at least. I also expect that interest rates and inflation will continue to rise. Floating-rate fixed income is one solution to get dependable income and some inflation protection. It therefore deserves a large allotment in your portfolio. Fixed income (preferred stocks and bonds) provides a rigid framework and a solid base to build upon. Not every part of your portfolio will be exciting and riveting, but these securities will provide you with long-term income and will help you sleep better at night. If you choose the right fixed-income products, you can also get the protection you need, and high yields at the same time.

10% Allocation to Healthcare

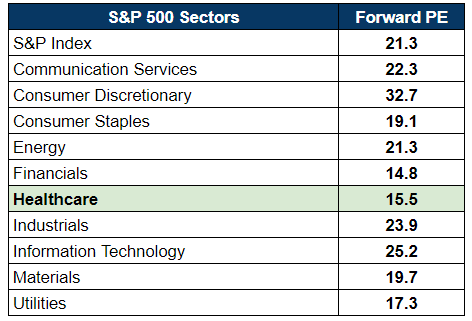

If you are looking for high growth at “bargain prices”, there’s no better place to invest than the Healthcare sector. Despite having very strong tailwinds, this is one of the cheapest sectors that the markets currently offer.

I started building up my allocation to Healthcare in the midst of the COVID-19 drop, and am still doing so. I see a strong tailwind beyond the pandemic. It comes as quite a surprise that, despite its “faster growth” than most other sectors, the P/E ratio of Healthcare and Pharmaceuticals puts it among the cheapest sectors today. It has lagged the S&P 500 index by a strong margin and has opened the door for a unique buying opportunity.

Yet, this is not the only reason why I am buying. This is a sector that has many strong tailwinds. Among the various tailwinds we are seeing, I want to suggest a few to mull over. I would start off by thinking about the aging U.S. population. This is driving up demand for long-term care and the need for medical assistance to ensure healthier, longer lives for individuals. Healthcare is often a massive expense during the retirement years. Since COVID-19 hit, Healthcare is more clearly understood to be an essential industry to the economic engine of a nation and its national security. For a long time, the idea of biological warfare using disease was scoffed at; with the recent pandemic, the idea of how that could occur has become more of a reality. Moving to the less macabre, we’re seeing the U.S. pharma industry in the spotlight with its successes through COVID-19, and many large firms have the potential for huge medical breakthroughs for all kinds of diseases in their pipelines. These breakthroughs will extend longevity and improve the quality of life. They are the “cash cows” of the future, ready for investors to benefit from today.

I have historically used high-yield CEFs (closed-end funds) to achieve exposure – and income simultaneously – to a large swath of the Healthcare space, such as:

- Tekla Healthcare Investors (HQH) which offers a 7.8% yield and trades at a 2.5% discount to NAV.

- Tekla World Healthcare Fund (THW) which offers a 9.3% yield paid on a monthly basis.

There are numerous advantages to investing in such funds. First, you get immediate diversification into the sector and you reduce your risk. The second is that these funds are actively managed by the best managers in the space. They monitor their portfolio and overweight the winners and sell potential losers, and therefore you get the biggest bang for your buck.

Two key aspects of Healthcare:

- Healthcare tends to be a recession-resilient sector. Just like gasoline or food staples, its demand tends to be extremely inelastic because it is needed in both good and bad times. Therefore, demand for companies’ products remains steady, and profitability and cash flows of such companies – as well as the dividends they pay – are dependable.

- This is a sector that has proven to be inflation-resistant. Throughout all the recessions in the US (including the Great Financial Crisis of 2007-2009, during which the unemployment rate reached 10%, having a devastating effect on the American economy), employment in the Healthcare industry grew. There are several reasons for this, including that the cost of healthcare can be directly passed to consumers, and that healthcare is a necessity rather than a luxury.

The bottom line is that the Healthcare sector has been one of the best-performing sectors over the long term. It is a defensive sector and every investor should have a good allocation to it.

Conclusion

As the economy reopens, your focus, as always, should be on income growth and inflation protection. If we see the expected economic expansion and rising inflation caused by the trillions of dollars of liquidity poured into the market by the government, you will want to have positioned yourself correctly now. By investing in fixed income and dividend stocks, you are buying today into cheap asset classes in a “not-so-cheap” market. By buying into Healthcare, you are investing in an undervalued area that deserves a healthy position in your portfolio, to reward you for years to come. The same can be said about floating-rate fixed income. Many investors are still overlooking floating-rate products and focusing on the yield they can lock in today. This has resulted in under-valuation in the floating-rate fixed income space, and you can still find some great bargains. Once short-term interest rates start to rise (or Mr. Market expects them to rise), it will be too late to get them at the current prices.

We’ve been adjusting our holdings to keep our income flowing through thick or thin, and to ensure that when inflation arrives we are not caught off guard.

I’m betting my retirement on it. Half of my retirement savings are in fixed income and Healthcare. That is not all; 100% of my retirement is invested into income-producing securities, including high dividend stocks. I’m not one to point at an opportunity and not have skin in the game.

I have been actively taking measures to ensure the high level of immediate income from my portfolio never stops and is benefiting from current trends. Our “Income Method” is leading the way in securing the retirements of countless investors against the risks of loss of income and the dangers of rapid inflation. I am looking forward to the discussion below, and will be happy to reply to any of your questions.