The Bull Will Survive The Latest Setback

This article was originally published on this site

- Recent weakness has convinced many that a bear market lurks ahead.

- This is strictly a short-term affair, as the weight of evidence proves.

- U.S. still remains most desired safe haven for world’s worried investors.

With geopolitical fears abounding, investors seem to have taken the bromide about selling in May literally. Many participants have begun an extended vacation away from the equity market, partly because they’re genuinely afraid of another major selling event. There’s also a growing concern on Wall Street that this summer could end up seeing the commencement of a new bear market. But as I’ll explain in today’s report, this fear is greatly misplaced. And while there are some justifiable concerns over the short-term equity market outlook, the market’s intermediate-term (3-6 month) internal and fundamental profile is remarkably sound.

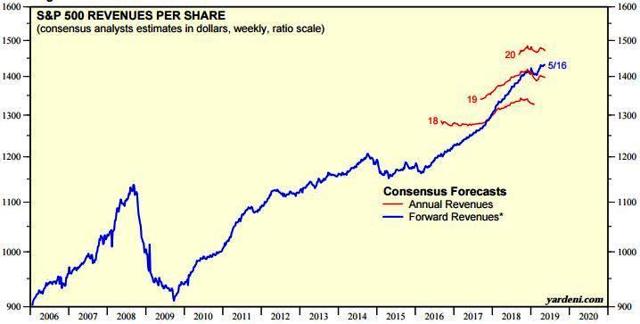

It’s not unusual for participation among equity investors to diminish starting in May, especially after the Memorial Day holiday. Many investment professionals head for the Hamptons or otherwise spend long periods away from the office as trading volumes diminish and interest in equities wanes. The month to date has proven to be no exception to that pattern as stock prices have gone essentially nowhere since April. Whatever interest still exists in the financial market has been largely confined to safe-havens like REITs, utilities, and Treasuries. In fact, utilities are among the very few stock groups which have actually managed to achieve new 52-week highs this month, as the Dow Jones Utility Average (DJIA) chart attests.

Source: BigCharts

And yet most sectors are dragging right now after failing to follow last month’s rally S&P 500 Index (SPX) rally to new highs. Some industry groups haven’t yet even overcome the highs from last year. This lagging performance has given rise to a feeling for many investors that bad things are ahead for the stock market this summer.

It hasn’t helped mollify investors that an increasing number of stocks on both major U.S. exchanges have made new 52-week lows in recent weeks. Among the categories of stocks which have consistently shown up on the new 52-week lows list are energy, healthcare, semiconductor, and retail companies. This is a broad enough collection of crucial industries to merit some concern among serious-minded investors. Most investment pros are aware that when stocks in several important industries are regularly making new lows, it’s a sign that at least some degree of liquidation is underway. An elevated number of new 52-week lows are also a potential danger sign for the near-term broad market outlook.

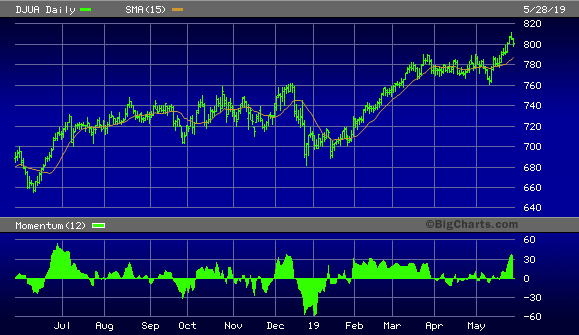

The following graph illustrates the gradual increase in the new 52-week lows in recent weeks. As you can see here, the NYSE new lows have risen gradually since hitting a major trough in February. A normal, healthy stock market environment is characterized by fewer than 40 stocks making new 52-week lows on a daily basis. And as can be seen here, there were less than 40 new lows on most days between the months of January and April. Since the start of May, however, new lows on the Big Board have increased to well above 40 on most days and have become a problem. The enlargement of stocks making new lows is an unhealthy sign for the short-term broad market outlook.

With stocks in some key areas of the tech and retail sectors making new 52-week lows, it’s hard to fault individual investors for being so defensive right now. Indeed, the growing concern over the market’s near-term outlook is justifiable based on the erosion taking place below the market’s surface. But does this mean the bull is in serious jeopardy of being killed this summer? The weight of technical and fundamental evidence argues against a bearish intermediate-term outlook. Let’s take a look at some of this evidence.

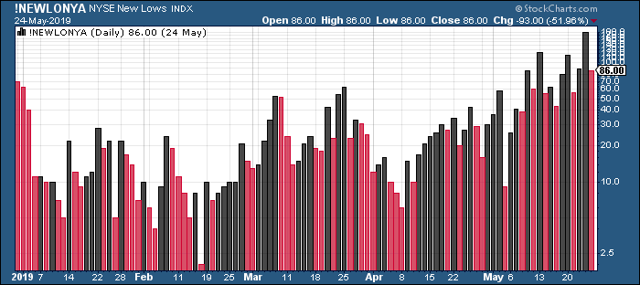

One of the most compelling arguments in favor of U.S. equity bull market overcoming the latest bout of weakness and making new highs later this summer is shown below. This chart illustrates the Wall Street analyst consensus forecast for S&P 500 revenues per share. With the corporate sales trend expected to continue its impressive upward trend of the last few years, there’s no reason to question the underlying validity of the bull market. Only when the S&P revenues per share trend flattens out or declines will there be any reason to question the bull’s fundamental basis.

Then there is the technical evidence which strongly suggests that upside momentum is still behind the stock market on an intermediate-term basis. Shown below is my favorite measure of the market’s interim momentum, namely the 120-day rate of change of the NYSE 52-week highs and lows. This indicator has been trending higher for most of 2019 and continues to rise even as the market’s short-term trend remains weak. Historically, whenever this indicator is in an upward trend it means that the stock market’s 3-6 month path of least resistance is to the upside. This is another reason for expecting a bullish resolution to the latest stock market pullback.

Source: WSJ

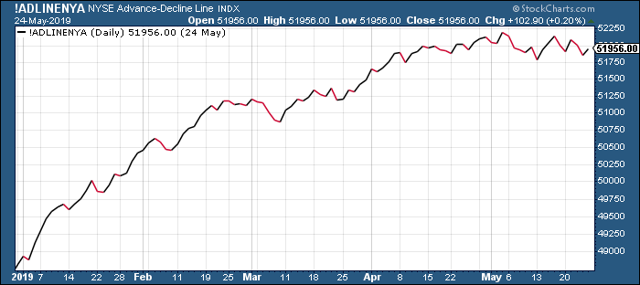

Yet another important sign that stocks are still in strong hands is the NYSE advance-decline (A-D) line. The A-D line is Wall Street’s favorite measure of market breadth, and the fact that it’s not declining shows that the latest selling pressure isn’t very broadly based. If anything, the A-D line proves that breadth is resilient given the degree of selling pressure in a few major sectors right now. The A-D line also suggests that there are still plenty of stocks in numerous industries which have remained immune to the aforementioned selling pressure. Every bear market of the past 20 years was preceded by a conspicuous decline in the A-D line, which let astute investors know that a distribution campaign (i.e. informed selling) was underway. That’s not the case today and this is an important argument against the bears’ case.

Another argument in favor of the bull market continuing this summer is that the U.S. remains one of the major receptacles for the flight-to-safety capital of the world’s worried investors. Even though many domestic investors are worried about the possibility of a bear market, the financial and economic outlook for much of Asia, Europe, and South America is decidedly less sanguine than that of the U.S. For this reason, foreign flight capital is still pouring into our country’s financial market. The stock market will continue to benefit from it in the months ahead.

As we’ve talked about in recent reports, the internal weakness currently visible in both the NYSE and NASDAQ markets is high enough to warrant a defensive posture in the immediate-term (1-4 week) outlook. However, the stock market’s intermediate-term outlook is far stronger and still supports a continuation of the 10-year-old bull market this summer. There are simply too many fundamental, technical, and liquidity arguments against the bear making a comeback anytime soon. Investors should accordingly expect a resolution of the current malaise and prepare for the rising trend in the SPX to resume within the next few weeks.

On a strategic note, my trading position in my favorite market-tracking ETF, the Invesco S&P 500 Quality ETF (SPHQ), was stopped out on May 10 after the ETF fell under the $31.70 level on an intraday basis, triggering my stop loss. This puts me back in a cash position in my short-term trading portfolio. Meanwhile, investors can maintain longer-term positions in fundamentally sound stocks in the top-performing consumer staples, real estate and utilities sectors as we wait for the latest short-term market weakness to dissipate.

Disclosure: I am/we are long XLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.