The Two Best Retail Stocks to Buy Before Thanksgiving

This article was originally published on this site

7,000 brick and mortar retail stores have closed this year. That beats the number closed during the 2008 recession and we could see as many as 1,600 more close before New Year’s.

And this includes “anchor” stores like Macy’s, Inc. (M), Nordstrom, Inc. (JWN), and Sear’s Holding Corp. (SHLD) closing many of their locations (Macy’s is closing 68 stores this year alone).

This presents a huge problem for anyone wanting to put their money on retail.

The good news is there are two companies that will prove to be your best bet…

The Real Money is Online, Not in Brick and Mortar Stores

This year, there have been at least 40,000 jobs lost in retail. And we’re entering the season when many of these retailers would beef up their hiring, at least for the part-time and seasonal jobs. And although that will happen, I doubt it will see the same hiring levels as past years. And this impact on the “anchor” stores, like Macy’s, Inc. (M), Nordstrom, Inc. (JWN), and Sear’s Holding Corp. (SHLD) as they fail to pull in the foot traffic they used to.

Anchor stores used to be considered the big prestigious retail stores. And many smaller companies rely on them to pull in the quality amounts of foot traffic they hope will feed into their stores. With the anchors doing poorly, the domino continues down the line to the smaller stores.

Now many people are saying the pain isn’t over for M and JWN. The anticipation is that these retailers will report deteriorating sales numbers due to less and less foot traffic.

It’s no secret online shopping is increasing by the day. And even though brick and mortar retailers are beefing up their efforts to sell online, Amazon.com, Inc. (AMZN) is still the online retailer most responsible for their declining sales.

AMZN is innovative in their approach and with the new Alexa and their Dash buttons (which allow consumers to re-order their favorite products over and over), Morgan Stanley (MS) analysts expect them to be able to capture 35% of all e-commerce sales in the fourth quarter. On top of that, consensus estimates state that AMZN alone will account for half of all U.S. retail growth this year.

While AMZN is the biggest name in online retail in the U.S., there’s another global online “e-tailer” that can go toe to toe with this juggernaut: Alibaba Group Holding Limited (BABA), the Chinese online commerce company.

Now shares in both AMZN and BABA may be too expensive for most people to stockpile (pun intended), even though the disparity in share price between the two is huge, AMZNis trading over $1,100 per share and BABA over $181 per share.

The good news is that’s where options can be used…

Options are a way to leverage the future price moves of these stocks, but even options on these companies can be pricey when you’re simply trading long calls.

The way around that is the “call debit spread” strategy. This is where you buy-to-open a call option at one strike price and then sell-to-open another call option on the same stock at a strike price higher than the one you bought, at the same time as a single trade. This creates a debit when you open the trade.

The goal is to have the option that you sold trade just higher than where you believe the stock will be at expiration, that way the spread gets exercised, and you make the difference in the strikes of the spread into your account (minus the initial cost).

You can even price out spread ideas to see how the spread will work.

Now assuming AMZN stays just above the strike price of the option you sold, it should have the potential to yield you a rate of return you are happy with.

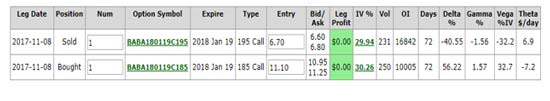

Let’s look at an example of a call debit spread with an expiry of January of 2018.

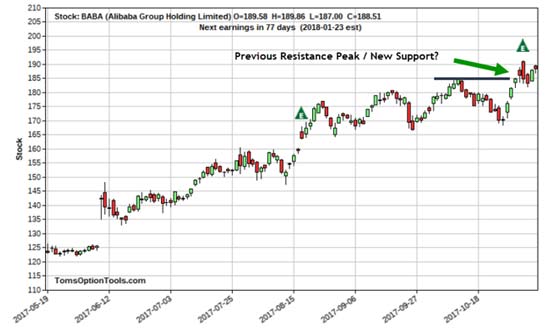

Alibaba Group Holding Limited (BABA)

In fact, a small group of my readers had the chance to score up to 106.19% on BABA in just 3 days. To find out exactly how they did it, click here.

Talk to your broker before trading spreads, you never want to buy and sell shares of a stock outright. You also don’t want to be paying commissions on those trades because those are trades you don’t want to place to begin with.

A spread trade should settle in cash. Meaning, for example, the markets exercise their right to buy BABA at $195 (which is the same as you then selling it at $195) and then you exercising your right to buy BABA at $185 (to sell it at the $195 price).

That should bring in $10 per share (or $1,000 on one contract) offset by the debit up front when you opened the spread trade, which was $440. This would result in a $560 profit per contract or a 127% gain.

To your continued success,

Tom Gentile