These 3 Buy-Rated Stocks are Decade-Long Outperformers

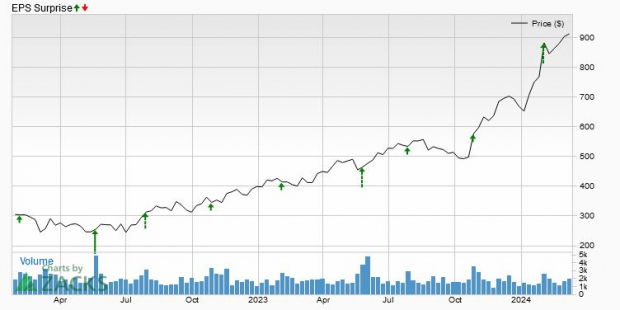

Investors are always searching for stocks that deliver market-beating gains. Interestingly, many stocks have done precisely that over the last decade, exceeding the S&P 500’s impressive 250% gain and 13.4% annualized return.

Three stocks – Deckers Outdoor (DECK – Free Report) , Applied Materials (AMAT – Free Report) , and Builders FirstSource (BLDR – Free Report) – have all outperformed the S&P 500 over the last decade, as we can see illustrated below.

Image Source: Zacks Investment Research

On top of market-beating performances, all three currently sport a favorable Zacks Rank, with analysts positively raising their expectations. Let’s take a closer look at each.

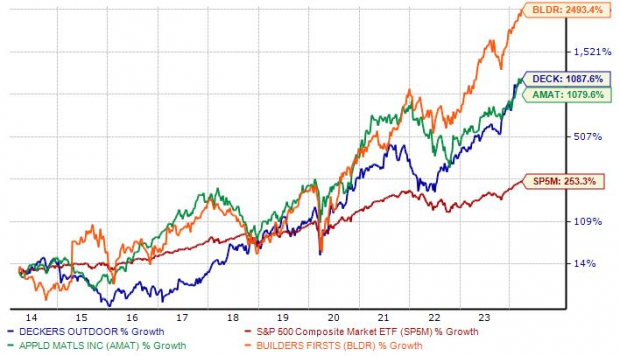

Applied Materials

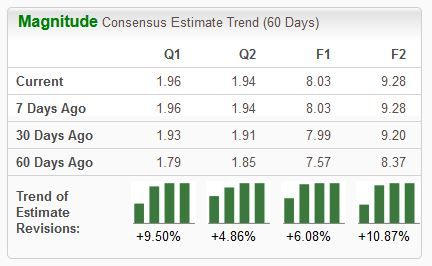

Applied Materials provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. Analysts have taken their earnings expectations higher across the board, landing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

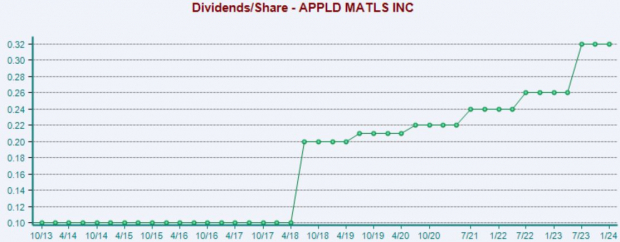

For those that like dividends, AMAT has that covered, with shares currently yielding 0.6% paired with a payout ratio sitting sustainably at 16% of the company’s earnings. Dividend growth is also apparent, reflected by AMAT’s 9% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

CEO Gary Dickenson recognized the company’s bright outlook in its latest set of quarterly results, saying, “Our leadership positions at key semiconductor inflections support continued outperformance as customers ramp next-generation chip technologies critical to AI and IoT over the next several years.”

Builders FirstSource

Builders FirstSource supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers.

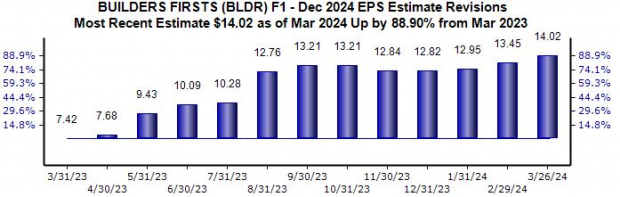

The company’s earnings outlook has been taken higher across several timeframes, with the revisions trend for its current fiscal year considerably bullish, up 89% to $14.02 per share over the last year.

Image Source: Zacks Investment Research

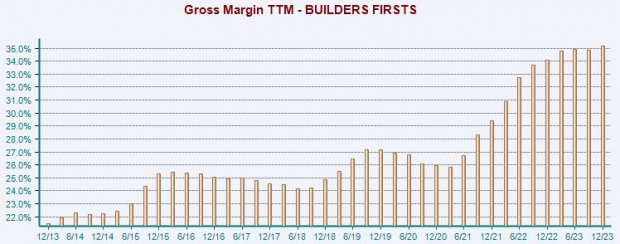

BLDR has enjoyed margin expansion amid operational efficiency, with the most recent trailing twelve-month gross margin of 35.2% reflecting the highest mark in the company’s history. It boasts strong cash-generating abilities as well, posting $1.9 billion in free cash flow throughout its FY23.

Image Source: Zacks Investment Research

Quarterly results have regularly blown away expectations as of late, with BLDR exceeding the Zacks Consensus EPS estimate by an average of 40% across its last four releases.

Deckers Outdoor

Deckers Outdoor, a current Zacks Rank #1 (Strong Buy), is a leading designer, producer, and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities.

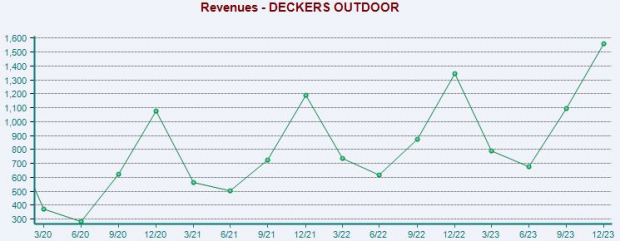

Growth is expected to stay, with strength across its UGG and HOKA brands expected to continue providing favorable tailwinds. Earnings are forecasted to climb 39% in its current year (FY24) on 15% higher sales, with FY25 expectations alluding to an additional 11% boost in earnings paired with an 11% sales climb.

The stock sports a Style Score of ‘A’ for Growth.

Image Source: Zacks Investment Research

Shares have been regularly boosted by better-than-expected results over the last year, as we can see below illustrated by the green arrows. Concerning its latest release, DECK posted a 32% beat relative to the Zacks Consensus EPS estimate and reported sales nearly 9% ahead of expectations.

Image Source: Zacks Investment Research

Bottom Line

Investors are always looking to beat the market. And perhaps to the surprise of some, all three stocks above – Deckers Outdoor (DECK – Free Report) , Applied Materials (AMAT – Free Report) , and Builders FirstSource (BLDR – Free Report) – have done precisely that over the last decade.

In addition to market-beating price action over a long-term period, all three currently sport a favorable Zacks Rank, reflecting optimism among analysts.

This article was originally published on this site