3 Buy-Rated Stocks for Artificial Intelligence (AI) Exposure

Artificial intelligence (AI) is Wall Street’s new obsession, with companies discussing the technology in a snowballing fashion and helping to keep market sentiment positive.

The robust quarterly results we’ve received from NVIDIA (NVDA – Free Report) over the last year have added further fuel to the fire, with the company flexing the scorching-hot demand it’s been witnessing regarding its AI chips.

Still, outside of NVIDIA, there are several other stocks investors can tap into for AI exposure, including Vertiv (VRT – Free Report) , Arista Networks (ANET – Free Report) , and Comfort Systems USA (FIX – Free Report) . For those interested in exposure to the technology, let’s take a closer look at each.

Vertiv

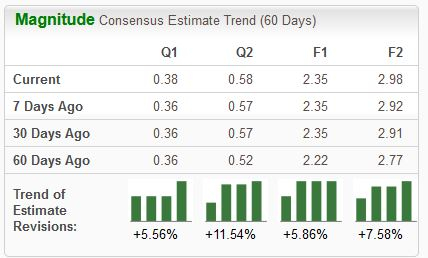

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services. Analysts have taken their earnings expectations higher across all timeframes, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

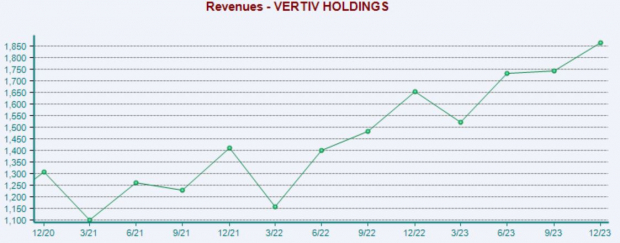

Scorching-hot demand for the company’s solutions has allowed it to post robust quarterly results, with Vertiv exceeding the Zacks Consensus EPS estimate by an average of 30% across its last four releases. The company’s top line has expanded nicely amid the frenzy, with VRT posting double-digit percentage year-over-year revenue growth in seven consecutive releases.

Image Source: Zacks Investment Research

It’s worth noting that VRT shares pay a small dividend, currently yielding 0.1% annually.

Arista Networks

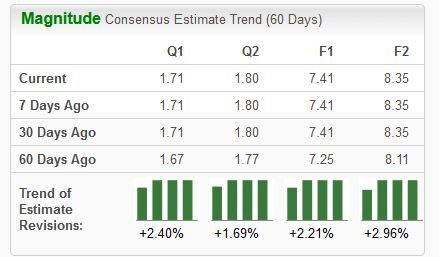

Arista Networks, a Zacks Rank #2 (Buy), is an industry leader in data-driven, client-to-cloud networking for large data centers, campus, and routing environments. Similar to VRT, analysts have raised their earnings expectations across the board.

Image Source: Zacks Investment Research

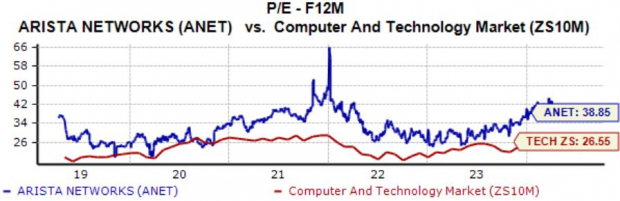

ANET shares trade at a high multiple, reflective of investors’ positive sentiment surrounding future growth. The current forward 12-month earnings multiple presently stands at 38.9X, above the five-year median and the respective Zacks Computer & Technology sector average.

Image Source: Zacks Investment Research

Keep an eye out for the company’s next quarterly release, expected in early May. Consensus expectations currently allude to 20% earnings growth paired with a 14% sales uptick.

Comfort Systems USA

Comfort Systems USA provides comprehensive heating, ventilation, and air conditioning installation, maintenance, repair, and replacement services. The company provides chillers, cooling towers, and other critical components found within data centers.

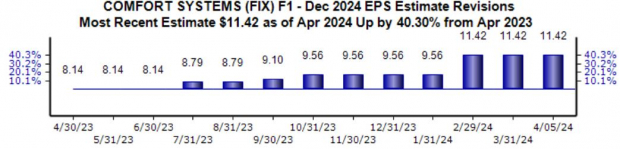

The stock boasts a Zacks Rank #1 (Strong Buy), with the revisions trend for its current fiscal year considerably bullish, up 40% over the last year and suggesting 30% year-over-year growth.

Image Source: Zacks Investment Research

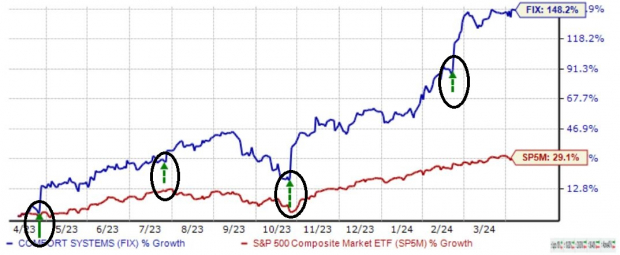

Like those above, better-than-expected quarterly results have regularly fueled shares over the last year, gaining a remarkable 150% and widely outperforming relative to the S&P 500. The company remains optimistic about its growth trajectory, underpinned by 27% year-over-year backlog growth in FY23.

Image Source: Zacks Investment Research

Bottom Line

The AI frenzy continues to dominate market headlines, with companies continuing to speak on the technology in a snowballing fashion.

It isn’t just beloved NVIDIA (NVDA – Free Report) enjoying the tailwinds, as Vertiv (VRT – Free Report) , Arista Networks (ANET – Free Report) , and Comfort Systems USA (FIX – Free Report) have also seen the same.

In addition to AI exposure, all three stocks above sport a favorable Zacks Rank, reflecting the optimism surrounding the technology.

This article was originally published on this site